Michael Saylor, Executive Chairman of Strategy (NASDAQ:MSTR), identified several challenges he believes are hindering the growth of the company and the wider Bitcoin (CRYPTO: BTC) treasury industry.

Saylor Talks About ‘Headwinds’

During the company’s third-quarter earnings call. Saylor was asked about the specific “headwinds” to the industry and steps required to overcome those.

“The fact that Bitcoin is not viewed as capital by the traditional credit ratings industry,” Saylor replied. He argued that failing to consider BTC’s collateral value under traditional banking, insurance and credit rating rules is a “structural” problem.

Bitcoin’s perception as capital by the traditional credit ratings industry is the first major hurdle. He argued that classifying Bitcoin as collateral and assigning it a collateral value under conventional banking, insurance, and credit rating rules is a significant structural problem.

Saylor alluded to this point earlier in the year, stating that while equity offerings have helped fund BTC accumulation, the real breakthrough lies in creating scalable, BTC-backed credit instruments.

Educate And Lobby, Says Saylor

The second issue, according to him, is banking acceptance, custody, and credit. He said that major U.S. banks purchasing, selling, and custodying Bitcoin, as well as issuing credit and margin lines against the asset, might be “great” for all parties involved.

“We don’t need a law to fix it. What we do need to do is lobby the banks, lobby the insurance companies,” Saylor emphasized.

The Bitcoin bull concluded by stressing the need to “educate” traditional fixed-income investors, retirees, and corporate treasurers about Bitcoin as a viable investment alternative.

Strategy Beats Revenue Estimates, Misses On Earnings

The remarks come in the wake of Strategy’s mixed third-quarter financials. The company reported earnings of $8.42 per share, missing the analyst consensus estimate of $10.57 per share. However, it exceeded revenue expectations, bringing in $128.69 million, compared to analyst estimates of $118.43 million.

Strategy disclosed holding 640,808 BTC, worth over $70 billion, on its books, strengthening its position as the world’s cryptocurrency treasury company.

Strategy also became the first Bitcoin-focused company to receive an S&P credit rating earlier in the week.

Price Action: At the time of writing, BTC was trading at $114,438.21, down 0.99% over the last 24 hours, according to data from Benzinga Pro.

Strategy shares soared 5.71% in after-hours trading after closing down 7.55% at $254.57 during Thursday’s regular trading session.

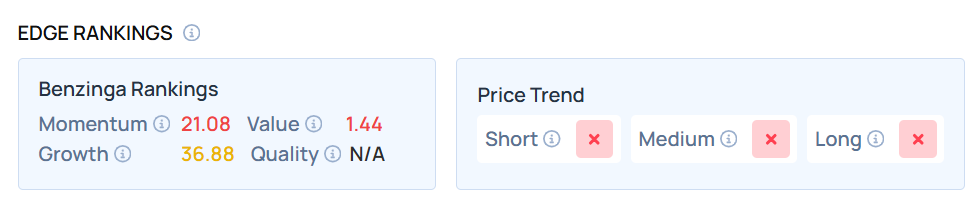

As of this writing, the stock demonstrated a very low Momentum score. Visit Benzinga Edge Stock Rankings to see how it compares with the highest-weighted stock in your portfolio.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Photo courtesy: PJ McDonnell / Shutterstock.com