On Thursday, the U.S. Food and Drug Administration approved Johnson & Johnson‘s (NYSE:JNJ) Tecvayli in combination with Darzalex Faspro for patients with relapsed or refractory multiple myeloma. The agency also selected the teclistamab MajesTEC-3 supplemental Biologics License Application to participate in the Commissioner’s National Priority Voucher pilot program. Phase 3 Data The decision was based […]

These Analysts Increase Their Forecasts on Target Following Better-Than-Expected Q4 Earnings

Target Corporation (NYSE:TGT) on Tuesday posted better-than-expected earnings for the fourth quarter. The company reported fourth-quarter adjusted earnings per share of $2.44, beating the analyst consensus estimate of $2.15. Quarterly sales of $30.453 billion (down 1.5% year over year) missed the Street view of $30.512 billion. The firm is looking for 2026 adjusted EPS of […]

Why Are Netflix Shares Sliding Monday?

Shares of Netflix Inc. (NASDAQ:NFLX) are trading lower in Monday’s premarket session. In separate developments, co-CEO Ted Sarandos said he expects a seismic wave of cost-cutting across Hollywood. Additionally, the streaming company formally withdrew its bid for Warner Bros. Discovery Inc. (NASDAQ:WBD), a move that leaves the door open for a competing takeover effort by […]

Trump Hails ‘Great News For America’ As Court Rejects Bid To Halt $400 Million White House Ballroom Plan

A U.S. judge has given the go-ahead for President Donald Trump‘s ambitious $400 million ballroom project at the White House, dismissing objections raised by preservationists. District Judge Richard Leon declined to grant a preliminary injunction that would have temporarily paused the project on Thursday. The National Trust for Historic Preservation filed suit seeking to delay […]

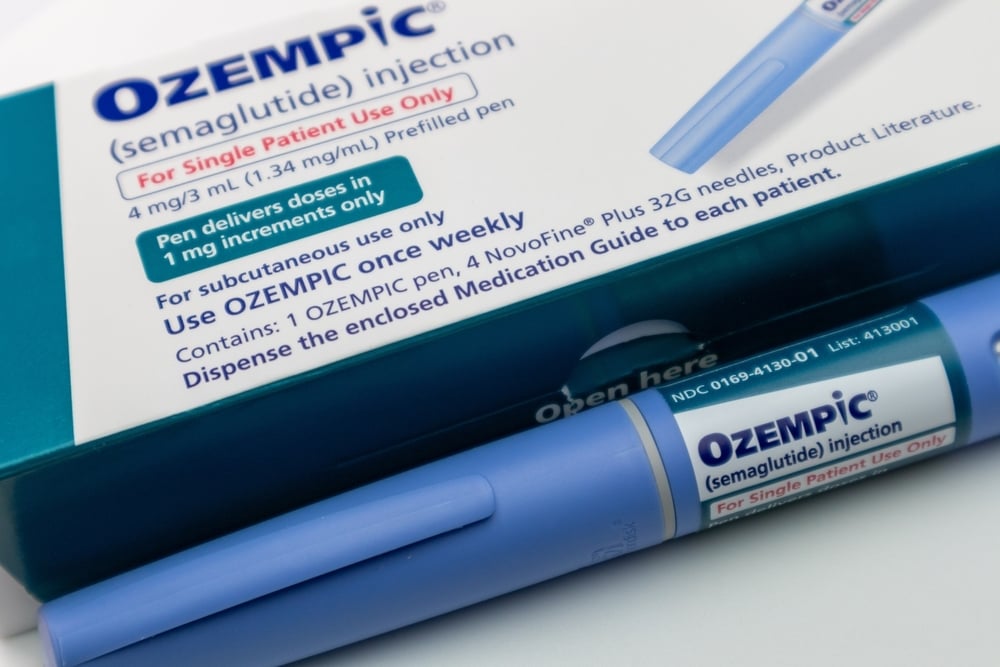

Ozempic Price War – Novo Nordisk Slashes Prices By 50%

Novo Nordisk A/S (NYSE:NVO) shares are down during Wednesday’s premarket session. The down move comes as the company announced plans to cut the list prices of its GLP-1 drugs by up to 50% in the U.S. starting in 2027, adding pressure as broader markets edged lower. Novo Nordisk Announces Major GLP-1 Drug Price Cuts The […]

Tom Lee: Bitcoin’s 50% Drop Is A ‘Crypto Squall,’ Not A Winter

Fundstrat’s Tom Lee called Bitcoin’s (CRYPTO: BTC) 50% drawdown a “crypto squall” rather than a structural collapse, arguing technology and crypto sectors could revive as tariff uncertainty lifts. The Squall vs. Winter Thesis Lee told CNBC on Friday that Bitcoin’s decline stems from macro shocks, not fundamental weakness in blockchain networks. He pointed to parabolic […]

White House Pushes Trump’s Ban on Investors with 100+ Single-Family Homes: Report

The White House is stepping up efforts to implement President Donald Trump‘s proposed ban on investors buying homes. A memo outlining the plan has been sent to House and Senate committee leaders, targeting investors who own more than 100 single-family homes and restricting them from acquiring additional properties, The Wall Street Journal reported on Thursday. The […]

Eli Lilly’s Experimental Cancer Drug Cuts Recurrence Risk In Early-Stage Lung Cancer Patients

Eli Lilly and Co. (NYSE:LLY) on Monday shared positive topline results from the Phase 3 LIBRETTO-432 clinical trial for Retevmo (selpercatinib). The trial demonstrated a highly statistically significant improvement in event-free survival for patients with early-stage non-small cell lung cancer. Lung Cancer Trial Shows Benefit The LIBRETTO-432 trial results showed that selpercatinib significantly reduced the […]

Newsletter

GameStop Is Back — What’s Fueling the 2025 Comeback?

June 18, 2025

Introduction GameStop Corp. (NYSE: GME) is once again making headlines in 2025, not just as a meme stock phenomenon, but as a company mounting a potentially serious turnaround. After years of volatility and skepticism, the stock has rallied more than 70% year-to-date—fueled by a new business strategy, improved financial performance, and a renewed wave of […]

Read More