Chapter

01

Road Map to Trading Success

By Chuck Hughes, Tradewins.com

“What goes up must come down spinning wheel got to go around.”

- Blood, Sweat and Tears

What really makes stock prices go up or down? Is it really as simple as what goes up must come down and vice versa? How do I select stocks with the best profit potential? Stock prices are constantly fluctuating and many times there seems to be no ‘rhyme or reason’ to this constant price fluctuation. The air waves and the Internet are flooded with analysts and experts who try to predict the future price moves for stocks.

Often they have no real answers to our same questions and are just as baffled by why a stock is going up or going down. Where does that leave us? Let’s face it; to the average investor the stock market can seem complicated and confusing.

Stocks can go up or down for no apparent reason. Apple reports great earnings but the stock plummets. The price of oil drops and the inflation report is tame but the major stock market indexes dive. Pfizer reports terrible earnings but the stock rallies. With the spinning wheel, going round and round, the ups and downs of the markets can leave anyone’s head going round and round. When it comes right down to it, the reason why stock prices are going up or down seems to be anybody’s guess. You might as well try to read tea leafs.

Highly paid analysts would have us believe that a company’s earnings outlook drive stock prices. Yet how many times have you seen the stock of companies with good earnings plummet while those with terrible earnings soar? Just like bad things happen to good people, big stock declines can happen to good companies. It is a fact of life with no true explanation.

But none of that matters for one simple reason. At the end of the day, if there are more buy orders for a stock than sell orders then the price of the stock will go up. And if there are more sell orders for a stock than buy orders, then the price of the stock will go down. It’s just that simple. Everything else is just noise. Everything else does not matter.

To make real money in the stock or options markets you don’t need to know why a stock price rises or falls, you just need to know two things: when to buy and when to sell. If you can quantitatively measure the buying and selling pressure of a stock then you will know in advance whether the price of a stock is likely to go up or down. And you will then know if you should take a bullish or bearish option position.

In other words, if you get a reading on the buying pressure and selling pressure for a stock you can successfully assess whether a stock is likely to go up or go down in price. There are numerous ways to measure the buying and selling pressure of a stock. We want to teach you several methods. That way you can use all the methods or just work with the methods you are most comfortable. Remember comfort and ease are what we are aim for!

The best way to measure buying and selling pressure is to track the daily price movement of a stock. If the daily price of a stock is increasing then the buying pressure is exceeding selling pressure and the stock is a ‘buy’. If the daily price of a stock is decreasing then the selling pressure is exceeding buying pressure and the stock is on a ‘sell’ signal.

One of the most important rules we learned as a novice investors was that you want to purchase a stock or call option only if the buying pressure exceeds selling pressure as indicated by the price of the stock trending up.

Trying to profit by investing in a stock with a price that is trending down is very difficult as it requires that you correctly predict when the price of the stock will ‘bottom out’ and resume a price up trend so that your stock or call option purchase can be profitable.

Buying a stock because it is cheap and then trying to predict when a stock’s price will bottom out can be nearly impossible to forecast correctly on a regular basis. This ‘crystal ball’ type of approach can leave the investor in a vulnerable position. A safer approach would be to wait until a stock’s price is in an uptrend before investing

A stock’s price movement reflects all of the known information about a company so let the price movement of the stock tell you when you should buy and sell!

One of the most effective ways to measure buying and selling pressure is to look at the daily price movement of a stock. There are numerous methods for tracking the daily price movement. We want to teach you one of our favorite and most effective ways. It is using a price chart.

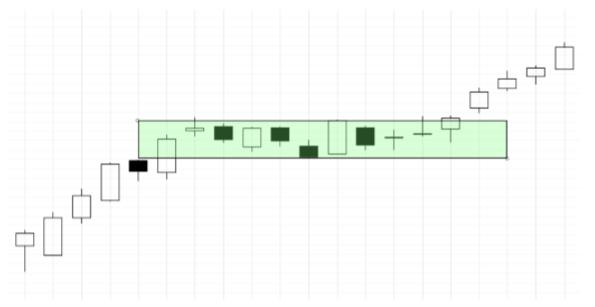

Price charts are a great way to get a visual look at the daily price changes and the price trend of a stock. It is the price trend that will determine if the stock is on a ‘buy’ or ‘sell’ signal and whether a bullish or bearish option trade should be taken.

For example, if the daily price trend of a stock is increasing then the buying pressure is exceeding selling pressure and a call option position should be initiated. If the daily price trend of a stock is decreasing then the selling pressure is exceeding buying pressure and a put option position should be initiated. Let’s take a closer look at price charts and how this tool will lead us to the path of success.

Daily Price Trend of a Stock Is Increasing = Call Option Position

Daily Price Trend of a Stock Is Deceasing = Put Option Position

Using Price Charts

Price charts are a great tool that helps us determine a stock’s price trend. The daily price chart below displays the daily price movement for Apple stock over a one month period. The horizontal axis at the bottom of the chart references the time period of the chart which is one month in this example from March 8th through April 8th. The vertical axis on the right side of the chart represents the price of Apple stock and in this example ranges from 218 to 242.

The vertical bars display the daily price movement of the stock. Each vertical bar has a horizontal line which represents the stock’s closing price for the day. On March 22nd the daily bar shows that Apple stock traded in a range from about 220 to 226 (circled). The closing price on March 22nd which is represented by the horizontal bar was about 225.

Determining the Price Trend

As noted previously we only want to buy a stock or call option if the buying pressure is exceeding the selling pressure as indicated by the price of the stock trending up. The best time to buy a call option is after the stock is already in a price up trend. We want to avoid stocks that are in a price down trend.

Daily price charts like the one just presented for Apple allow us to instantly see the price trend of a stock. We like to take this visual look at a stock’s price movement one step further and actually measure the price movement. The easiest and simplest way to measure price movement is to use what are called ‘moving average lines’.

Next, we are going to take a look at when to buy and when to sell. This concept always reminds me of an old Kenny Rogers song:

You got to know when to hold ‘em, know when to fold ‘em - Know when to walk away, know when to run.

Yes, with stocks you need to know when a stock is on a ‘buy’ signal or ‘sell’ signal. You are about to learn indicators that can quantitatively measure if a stock is moving up in price or moving down in price.

These indicators let us know in advance the most likely future price movement of a stock. We will then know if we want to buy call options or put options.

Determining the Most Likely Future Price Movement

Moving Average lines are a great trading tool that allows us to know in advance the most likely future price movement for a stock. We know the term Moving Average line may seem complicated but a Moving Average line is simply the average closing price of a stock over a specified time period. For example, the 50-Day Moving Average line represents the average closing price of a stock over the past 50 days.

Many times the real price trend of a stock can be obscured by the daily price fluctuations. The daily price chart below for Apple stock covers the 3 month period of November, December and January. As we learned in the previous price chart example for Apple, the vertical bars display the daily price movement of the stock.

This price chart shows a rally for Apple stock until mid-November and then a price decline into mid-December. This price decline is followed by another rally into the beginning of January followed by another price decline in January. Despite the daily price fluctuations the stock price was little changed over the 3 month period.

Three Month Price Action Shows No Clear Trend

Let’s take another look at a price chart for Apple stock that covers a longer time period but includes the November, December and January period just mentioned. This price chart also includes the 100-Day Exponential Moving Average (EMA) line for Apple stock. We prefer to use Exponential Moving Averages over Simple Moving Averages as we have found Exponential Moving Averages to be more accurate in determining the price trend. Exponential Moving Averages give more weighting to recent price movements than Simple Moving Averages which give every day an equal weighting.

100-Day EMA Line is Sloping Up

Clearly Indicating a Price Up Trend

The 100-Day Exponential Moving Average (EMA) line is sloping up clearly indicating Apple stock is in a price up trend. Moving average lines give us an instant visual reference of the current price trend of a stock.

- If the moving average line is sloping up, the stock is in a price up trend and buying pressure is exceeding selling pressure. Call options should be purchased.

- If the moving average line is sloping down, the stock is in a price down trend and selling pressure is exceeding buying pressure. Put options should be purchased.

It is that simple! Moving averages tell us if a stock is on a ‘buy’ signal or ‘sell’ signal instead of trying to predict the future price movement of a stock. You can easily and quickly obtain moving average lines from numerous websites which will be covered shortly.

Buy and Sell Signals

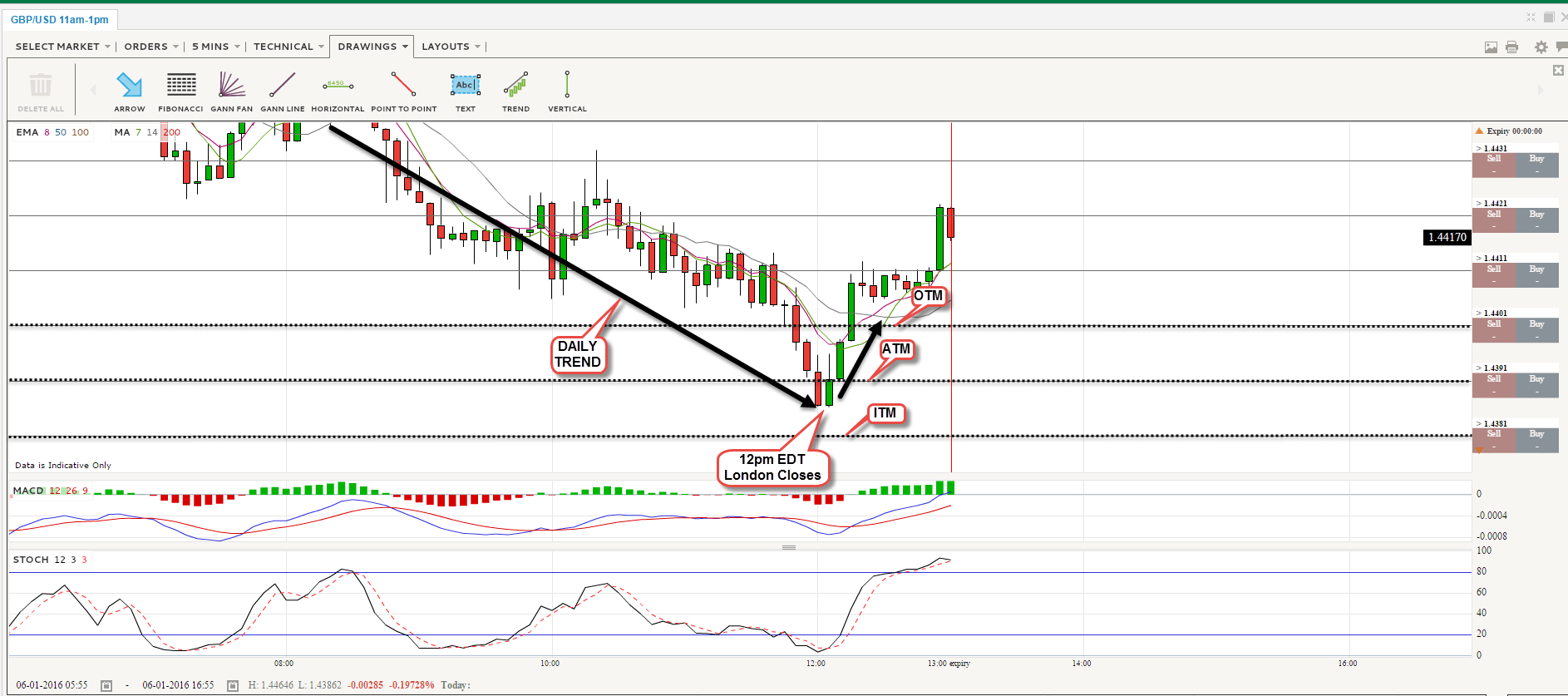

One of the easiest ways to clarify whether a stock is a ‘buy’ or a ‘sell’ is to look at the shorter term 50-Day Exponential Moving Average (EMA) line in relation to the longer term 100-Day Exponential Moving Average (EMA) line.

If the shorter term 50-Day EMA line is above the longer term 100-Day EMA line it indicates the price momentum for the stock is to the upside which confirms the price up trend. We should initiate a call option trade for the stock.

If the shorter term 50-Day EMA line is below the longer term 100-Day EMA line it indicates the price momentum for the stock is to the downside which confirms the price down trend. We hould initiate a put option trade for the stock.

Buying and Selling Pressure

When the shorter term 50-Day EMA line is above the longer term 100-Day EMA line it is an indication that the buying pressure for a stock is exceeding the selling pressure. And the most likely future price movement of the stock is up. The stock is on a ‘buy’ signal.

When the shorter term 50-Day EMA line is below the longer term 100-Day EMA line it is an indication that the selling pressure for a stock is exceeding the buying pressure. And the most likely future price movement of the stock is down. The stock is on a ‘sell’ signal.

‘Buy’ Signal Example

Let’s look at an example of a ‘buy’ signal. The Apple stock daily price chart below displays the 50-Day EMA line and the 100-Day EMA line. The moving average lines indicate that Apple stock entered a price ‘up’ trend in April (circled) as the 50-Day EMA crossed above the 100-Day EMA line.

When the 50-Day EMA crossed above the 100-Day EMA it was a good indication that buying pressure was exceeding selling pressure and you want to take bullish option trades for Apple. As long as the 50-Day EMA line remains above the 100-Day EMA line Apple stock remains a ‘buy’ and bullish option trades should be maintained.

In this example the Apple 50-Day EMA line crossed above the 100-Day EMA line in April. We purchased Apple stock and call options after the April buy signal. Apple remains in a price ‘up’ trend if the 50-Day EMA line remains above the 100-Day EMA line indicating that buying pressure continues to exceed selling pressure. Monitoring the 50-Day and 100-Day EMA lines is an easy and effective way to determine the current price trend which tells us if we should be taking bullish or bearish option trades for Apple stock.

If the 50-Day EMA crosses below the 100-Day EMA it would indicate a reversal to a price ‘down’ trend as the selling pressure is now exceeding the buying pressure. You should take bearish option trades for the stock when this occurs. We will look at an example of a sell signal next.

50-Day EMA line Above 100-Day EMA line = Buy

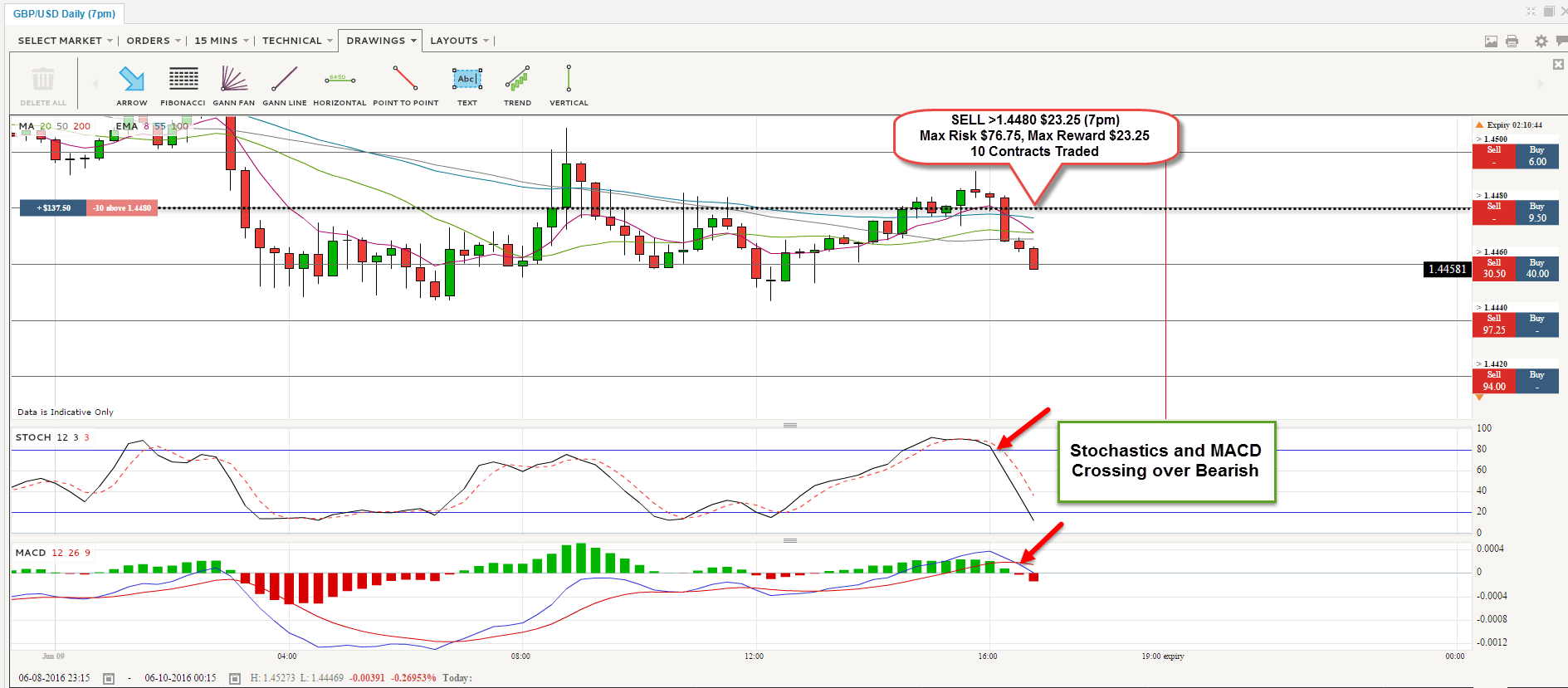

Sell Signal Example

Let’s look at an example of a ‘sell’ signal. The daily price chart below shows the daily price movement and the 50-Day and 100-Day EMA lines for Merck stock. This chart reveals that in February the Merck 50-Day EMA line crossed below the 100-Day EMA line (circled) resulting in an EMA System ‘sell’ signal for Merck stock.

When the 50-Day EMA crossed below the 100-Day EMA it was a good indication that selling pressure was exceeding buying pressure and you want to establish bearish option positions for Merck stock. You want to hold on to the bearish option positions for Merck while the price trend is ‘down’ and at this point the length and severity of the price decline is still unknown.

As long as the 50-Day EMA line remains below the 100-Day EMA line Merck stock remains a ‘sell’. Merck does not qualify as a buy until the 50-Day EMA line crosses above the 100Day EMA line.

Monitoring the 50-Day and 100-Day EMA lines is an easy and effective way to determine the current price trend which tells us if we should be establishing bullish or bearish option positions for Merck stock.

50-Day EMA Below 100-Day EMA = Sell

The 50/100-Day EMA trend following system is your road map to investing success. Trend following is a powerful, systematic approach that allows us to profit from the powerful profit opportunities available from trading weekly options.

Historical Results Of EMA System

The 50/100-Day EMA System is a rule based system with clearly defined ‘buy’ and ‘sell’ rules. This enabled us to do historical testing with the help of the Omega Research Trade Station program using the 50/100-Day EMA Cross Over System just presented. Historical profit results are based on buying a stock when its 50-Day EMA line crosses above the 100Day EMA and selling a stock when its 50-Day EMA line crosses below the 100-Day EMA. The profit/loss for each trade is calculated and a cumulative total is maintained for each testing period.

The EMA System is universal in nature and has been profitable for short term investing across a wide range of markets including: stocks, options, indexes, closed-end funds, zero coupon bonds, mutual funds, index funds and sector funds. The fact that the system is profitable in virtually every type of market confirms its credibility as a viable, robust approach to trading the financial markets.

Included on the following page are profit results for a well-diversified sampling of both growth and value stocks that represent a broad cross section of 26 different industry groups. This sampling includes small, mid and large cap stocks. Historical profit results were generated over a recent twenty four year period.

Profitable with Low Risk

Keep in mind that four bear markets occurred during this period. Results are based on trading one hundred shares of stock for each ‘buy’ signal and do not include commissions.

Let’s review the tests conducted using the first stock tested Aetna Health Care (AET). The first time Aetna’s 50-Day EMA crossed above the 100-Day EMA during the test period one hundred shares of Aetna were purchased at 10.18.

The profit/loss for each AET trade was calculated by the Trade Station software and the profits totaled $5,376 over the test period based on trading 100 shares for each buy signal. This $5,376 profit represents a 528% return on the initial investment of $1,018.

The software divides the total profits by the total losses to calculate the Reward to Risk Ratio. Aetna had a Reward to Risk Ratio of 3.9 as there were 3.9 dollars of profit for each 1 dollar of loss. There were 10 losing trades over the 24-year period and the average losing trade incurred a -$120 loss.

Average Yearly Return of 107%

The total initial investment required to buy 100 shares of each of the 34 stocks over the test period was $8,204. This $8,204 initial investment produced a total of $210,578 in profits over the test period which equates to a 2,567% return. The average yearly return was 107% which would enable us to double our initial investment every year on average. This average 107% annual return was achieved without the use of leverage or margin. Trading options instead of stock would have resulted in a much higher rate of return over the test period as options provide leverage.

The historical results demonstrate that the EMA System has the ability to produce ample profits with very low risk. Of the trades that were losing trades, the average loss over the twenty four year period was $150 and when compared to the total profits of $210,578 demonstrates the ability of the system to keep losses to a minimum. The average Reward to Risk ratio was a very healthy 12.7 with over 12 dollars of profit for each 1 dollar of loss again demonstrating a very healthy risk-adjusted return.

The preceding investing results demonstrate the importance of ‘investing with the trend’ if you are a short term investor. The 50/100-Day EMA System allows us to know in advance the most likely future price movement of a stock and reduces the entry and exit timing risk associated with short term investing.

It is a versatile, effective method for profiting in any type of market and can quickly identify stocks on a ‘buy’ or ‘sell’ signal. This allows us to profit from trading options by purchasing call options for a stock on a 50/100-Day EMA System ‘buy’ signal and purchasing put options for a stock on a 50/100-Day EMA System ‘sell’ signal.

Equally important is the ability of the system to avoid large losses which can quickly ruin an investment plan. The system keeps losses to a minimum and almost always exits a trade before a big loss occurs. Following a discipline that keeps losses to a minimum is one of the most important characteristics of a successful short term investing program. Keep in mind that the worst bear market since 1932 occurred during this test period.

The 50-Day and 100 Day-EMA Lines Are the Key to Developing a Profitable Strategy

The stock market is in a constant state of flux. The constant up and down price movement of a stock makes it difficult at times to see the real price trend of a stock. That is why it is important for an investor to become comfortable with the 50/100-Day EMA lines.

The position of the 50-Day EMA in relation to the 100-Day EMA gives us a quick and accurate indication of a stock’s current price trend. If the stock is in a price up trend call option trades should be initiated. And if the stock is in a price down trend put option trades should be initiated. In order to be a successful option investor we do not have to know what an analyst’s rating is for a stock or the current earnings projection. All of that information is already reflected in a stock’s price movement which can be quantitatively measured by the 50/100-Day EMA lines.

This simple but effective trend following system is mechanical in nature and instantly tells you if you should be taking a bullish or bearish option position. We prefer mechanical systems as they take the emotion out of trading. There is no judgment or interpretation involved. You don’t have to rely on trying to predict future price movement.

Follow the Price Trend Instead of Trying to Predict It

“Prediction is very difficult, especially if it’s about the future.”

- Nils Bohr

The 50/100-Day EMA System allows us to ‘invest with the trend’ instead of trying to predict the price direction of a stock. The historical studies presented demonstrate that price trends tend to continue in the same direction and can continue on longer than one may initially expect.

Our investing experience confirms that the 50/100-Day EMA System allows us to know in advance the most likely future price movement of a stock and whether we should be initiating bullish or bearish option trades.

THE SPECIAL OFFER

To learn more about Chuck’s unique approach to options trading, tap the link below to get a free copy of his new eBook “Options Trading Made Easy”.

This free options trading course will teach you everything you need to know if you want to start trading options in the simplest, most profitable way possible.

ABOUT THE AUTHOR