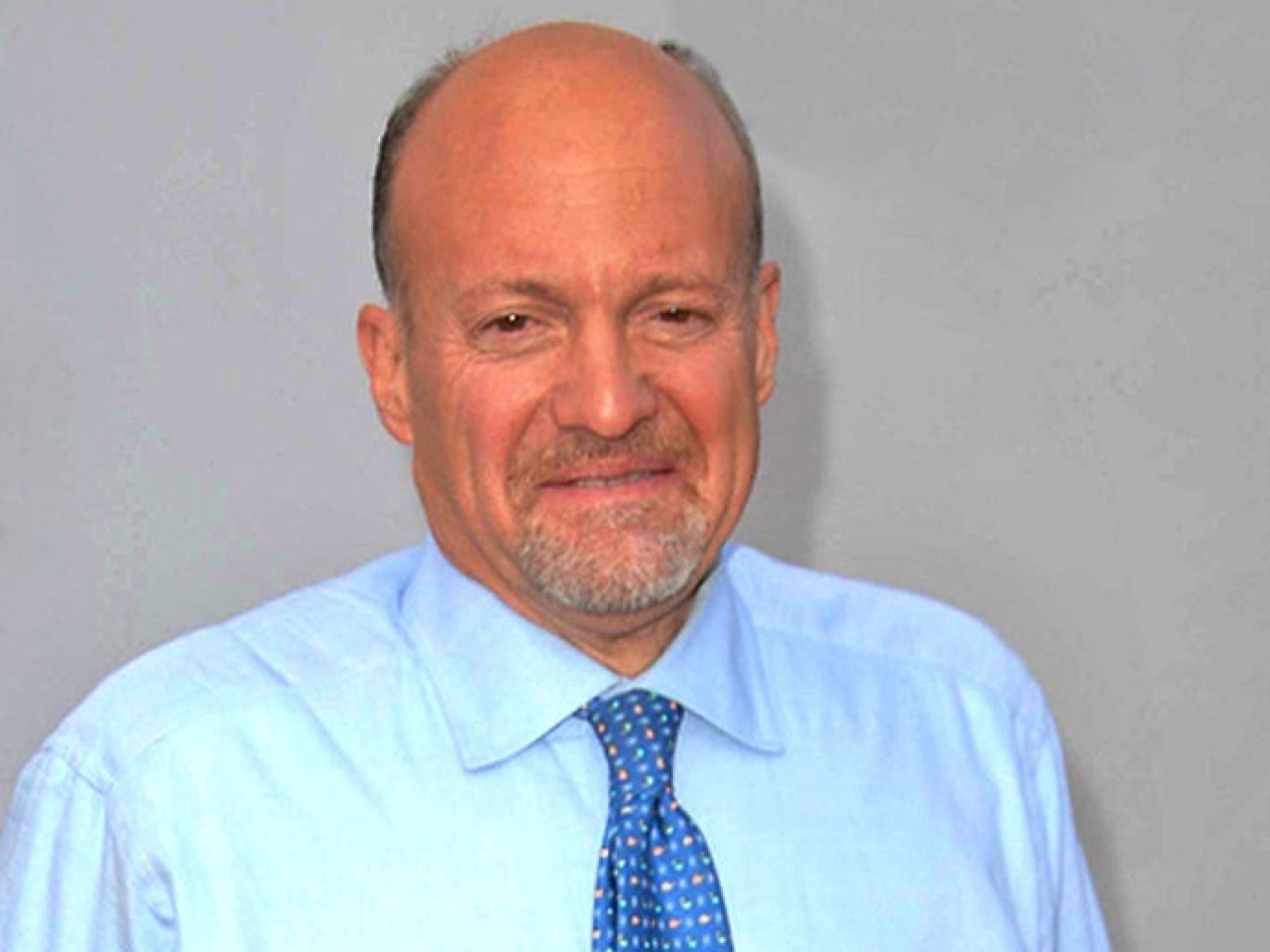

Investors are increasingly scrutinizing company earnings as market volatility continues to shape investment strategies. Amid this climate, key figures like Jim Cramer are vocal about their preferences, emphasizing growth potential and stability in their stock picks.

On CNBC’s “Mad Money Lightning Round,” Cramer said he doesn’t like AGNC Investment Corp. (NASDAQ:AGNC). “It is not a growth vehicle, I like growth,” he added.

Supporting his views, AGNC Investment, on July 21, posted weaker-than-expected earnings for the second quarter. The company reported quarterly earnings of 38 cents per share, which missed the analyst consensus estimate of 41 cents per share.

Cramer said he doesn’t like to buy stocks that are under investigation, when asked about UnitedHealth Group Incorporated (NYSE:UNH). However, he added, “there are some people who seem to know that the worst is over.”

As per the recent news, UnitedHealth on Tuesday disclosed plans to reaffirm its previously announced earnings target and confirm consistent Medicare Advantage ratings. UnitedHealth reaffirmed its adjusted 2025 EPS expectations set on July 29 of at least $16.00 per share, slightly below the analyst consensus of $16.24 to $16.30. The health care giant noted that the Amedisys acquisition will be dilutive to 2025 adjusted EPS due to financing costs and integration investments, but maintained the $16.00 EPS target.

Price Action:

- AGNC shares rose 0.1% to settle at $10.35 on Tuesday.

- UnitedHealth shares gained 8.6% to close at $347.92.

Read Next:

Photo via Shutterstock