Butterflies provide a low-risk high reward trading opportunity. Market direction can go through months, and even years of higher than usual uncertainty. Technical analysis may be painting one picture, while the economic or political environment is painting another. This can be both stressful and costly. The Butterfly strategy offers a solution to this dilemma that all traders face on a regular basis.

While there’s always some degree of uncertainty that traders and investors must accept, there can be long frustrating periods of higher than usual conflicting signals. This increases risk for traders and investors. Yet, waiting on the sidelines has opportunity costs. For traders who have come to rely on regular income from trading, loss of that income can cause serious lifestyle problems. These situations call for a strategy that will work no matter which direction the market heads.

That’s exactly what the highly versatile Butterfly strategy does. It gives you a trading advantage in any type of market environment. This makes it a powerful strategy that every serious trader will want to add to their arsenal of skills.

Many traders know of the advantages of the Butterfly, yet they may have avoided it because of its complexity. Initially, the setup can seem overly complicated. This is because most traders try to master the Butterfly without truly understanding a few basic option trading principles first.

In this presentation, I’m going to simplify the Butterfly for you. The reality is that once you grasp these basic concepts, you’ll see that the Butterfly is just marrying a couple of simple setups that you probably already know. Serious traders take the time to master the skills to increase their returns while lowering their risk. The Butterfly is one powerful way to do that. Since many traders avoid the Butterfly, by taking time to master it is going to give you a powerful edge up on traders who continue to avoid it.

Here is what you’ll learn

- Best Market Conditions for Butterflies

- Benefits of Butterflies

- The Option Greeks You Need to Know First

- The Most Important Option Factor

- The Butterfly Setup

I. Best Market Conditions for Butterflies

Unlike other option strategies such as iron condors, credit spreads, or debit spreads that only work with an identified objective based on probable market direction, Butterflies can be set up and traded for a variety of objectives based on where a trader thinks the security or market is headed, as outlined below. One of the best things about Butterflies is that they are ideal regardless of market direction!

1. You Just Don’t Have Any Idea Where the Market is Headed

Non-Directional – Here’s the real beauty of the Butterfly! In their simplest form, butterflies can be delta neutral or non-directional trades. This means they can be used successfully when you simply DO NOT KNOW the market direction. Trying to pick the direction of stocks or the overall market can be stressful and expensive. Delta neutral butterflies can be set up to take the guesswork out of trading.

2. You Feel Pretty Sure the Market Is Headed Up or Down

Directional – The Directional Butterfly Spread can also be used for bullish or bearish exposure to the market while also managing risk and retaining large potential returns.

There’s no such thing as a free lunch: Butterfly spreads cannot offer unlimited profit potential. But they usually cost less than buying options outright while providing a powerful positive risk reward trade set-up that simply cannot be found with other trading strategies.

3. You Don’t Want to Lose Your Shirt!

Hedging – The Directional Butterfly can be used as a fast to execute hedge on positions that are moving against you. This is exactly what the most sophisticated companies do. They hedge, and so can individual traders! Note: This lowers trading stress!

Constructing a butterfly around a strike that is under pressure from another core trade (such as a credit spread or debit spread) controls risk.

This allows you to keep the original position open, buying time. Often, additional time is all that’s needed for a trade to move back to profit territory. At that point you can then remove the butterfly hedge and stick with your original trade.

Butterflies provide cheap protection! Many longer-term investors and swing traders buy puts for portfolio insurance. Long term out-of-the-money put butterflies, however, can be a much cheaper method of portfolio protection than pure long puts.

II. Benefits of Butterflies:

Income – Butterflies can be used to generate income from stocks that appear to be going nowhere in the short term. This alleviates overall portfolio returns in flat markets.

Low Cost – Butterflies can best structured and traded at a very low cost.

Risk Reward – A 10-to-1 or higher Reward-to-Risk is common. This fantastic risk reward ratio makes them well worth the effort to learn the structure.

Low Maintenance – Butterflies are sometimes called “vacation trades” due to their low risk and need for only very infrequent monitoring.

- Butterfly trades are generally very slow moving early on in the trade.

- But get more exciting and volatile as they approach expiration and are within the profit tent (Zone).

Is this simple 4 letter code the secret great trades in 72 hours?

This string of code could be very productive in just 72 hours. Really. This code has spit out 321 winning trades out of 324 tries in the past three years. That’s a 99.1% success rate.

Click here right now to see the INSANE details.

III. The Option Greeks You Need to Know First

The “Greeks” provide a way to measure the sensitivity of an option’s price to quantifiable factors. The Greeks are strictly theoretical. That means the values are projected based on mathematical models and all of the best commercial options-analysis packages will do this, and on some of the better brokerage sites they are free.

Brief Review of the Greeks

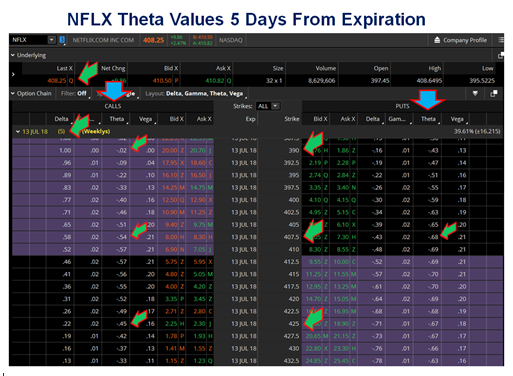

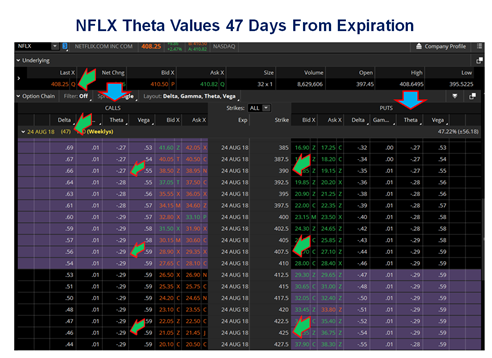

Theta – (decay movement) measures your time decay (per day) – increases each day as it gets nearer EXP. & at zero at EXP.

Implied Volatility – (price movement) what the marketplace is “implying” the volatility of a stock will be in the future & its effect on where price will be

Delta – (price movement) measures the change per $1 change in the underlying & a measure of price probability

Vega – (volatility movement) measures the change per 1% change in volatility, decreases each day & at zero at EXP.

Gamma – (price movement) is the rate of acceleration of delta based on a $1 change in the underlying – most at risk & largest impact last week of EXP.

IV. The Most Important Option Factor

The most important option factor for profit generation using the Butterfly Strategy comes down to understanding the concept of TIME, and its effect on the price of an option…

Time Value ~ is used for trading strategies that take advantage of the accelerated Time Decay of an option into its Expiration. Butterfly Strategies are very tied to Time Value (Theta) & the impact it has on the price of an option.

What exactly is Time Value?

Time value (TV) (extrinsic) of an option is the premium a rational investor would pay over its current exercise value (intrinsic value), based on its potential to increase in value before expiring. This probability is always greater than zero, thus an option is always worth more than its current exercise value. The change in the value of an option, based on Time Decay, can be measured using the Greek, Theta…

Option Theta

Theta tells you how much an option’s price will diminish over time, which is the rate of time decay of a stock’s option.

Time decay occurs because the extrinsic value, or the Time Value, of options diminishes as expiration draws nearer.

By expiration, options have no extrinsic value and all Out of the Money (OTM) Option expire worthless.

The rate of this daily decay all the way up to its expiration is estimated by the Options Theta Value.

Understanding Option Theta is extremely important for the application of option strategies that seeks to profit from time decay.

Options Theta – Characteristics

Option Theta values are either positive or negative.

All long stock option positions have negative Theta values, which indicates that they lose value as expiration draws nearer.

All short stock option positions have positive Theta values, which indicates that the position is gaining value as expiration draws nearer.

Theta value is highest for At the Money (ATM) Options

And progressively lower for In-The Money (ITM) and Out-of-The Money (OTM) options.

ITM and OTM options have much lower extrinsic values, giving little left to the decay.

For Example:

An option contract with Option Theta of -0.10 will lose $10 per contract every day even on weekends and market holidays.

The buyer/holder of an option contract over a 3-day long weekend with a price of $1.40 or $140 per option contract and an option theta of -.10 will find the price of that option at $110 instead of $140 after the 3-day weekend.

Theta Decay Strikes!

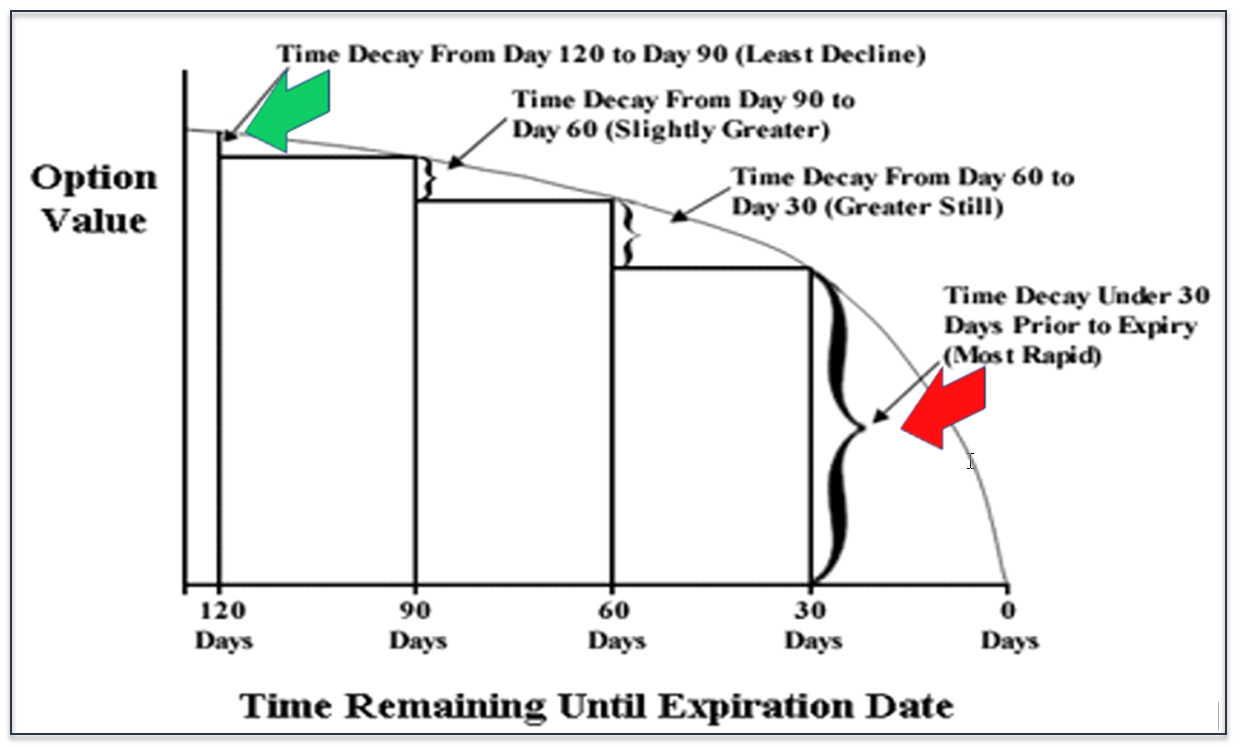

Option theta does not remain stagnant.

It increases as expiration draws nearer and decreases as the options go more and more In-The-Money or Out-of-The Money.

In fact, the effects of Option Theta decay is most pronounced during the final 30 days to expiration where theta soars.

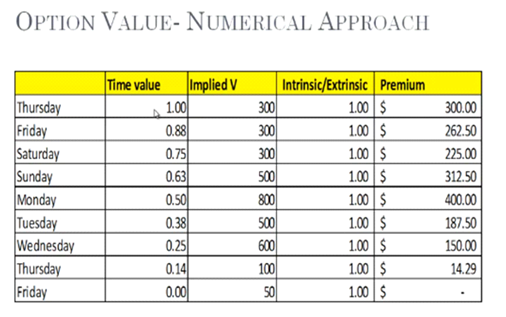

Take a look at the following chart to see just how predictable and powerful this option paradigm is!

How Option Pricing Works

How to value an option

Time Value (x) Implied Volatility (x) Intrinsic/Extrinsic Value

Note: Once you know these variables then you are ready to price an option & know what its option premium should be.

The Butterfly Foundation – Vertical Spreads

Butterfly Foundation: Vertical Debit & Vertical Credit Spread

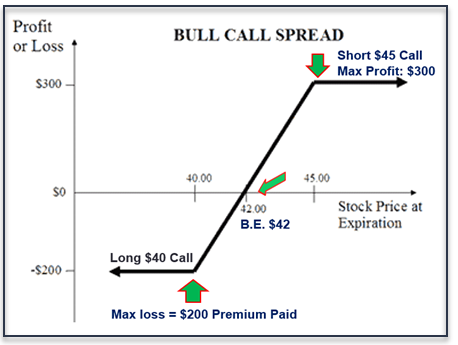

Vertical Debit Spread:

A “bull call” spread, entails buying one call and selling a higher-strike call that will be lower in price to offset some of the premium cost & theta decay

A “bear put” spread entails buying one put and selling a lower strike put, that will be lower in price to offset some of the premium cost & theta decay

These spreads are done for a debit

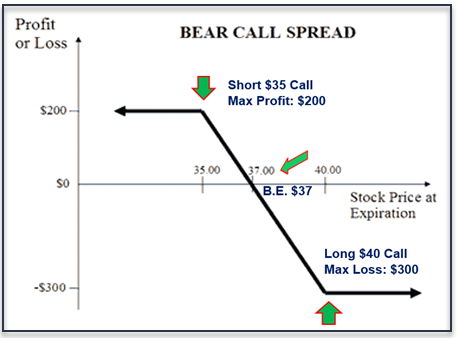

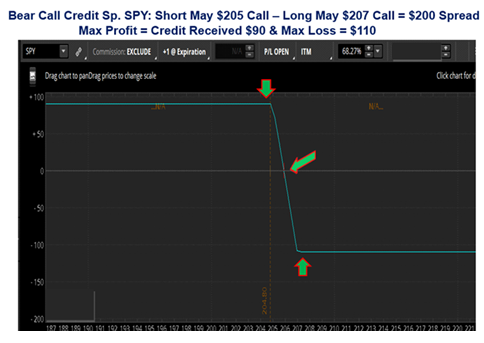

Vertical Credit Spread:

A “bear call” spread, entails selling one call and buying a higher-strike call that will be higher in price to hedge the short call. Premium collection.

A “bull put” spread, entails selling one put and buying a lower strike put that will be lower in price to hedge the short put. Premium collection.

These spreads are done for a credit:

Vertical Bull Call Debit Spread

Vertical Bear Call Credit Spread

Selecting the Right Butterfly Option Strategy

One major goal of every trader should be to select trades based on what provides the most consistent positive return with low, defined risk. Not always the greatest return.

And one of the best ways to achieve this is by knowing the Option Butterfly Strategies that are available, how they work and then selecting the one that is best suited for the market environment you are trading.

Butterfly Strategies

- Long Call or Put Butterfly

- Short Call or Put Butterfly

- Broken Wing Call or Put Butterfly

- Unbalanced-Ratio Butterfly

- Broken Wing Unbalanced-Ratio Butterfly

- Directional Butterfly

- Iron Butterfly

- Hedging – Defenses Using Butterflies

The Butterfly Foundation = The Balanced Butterfly

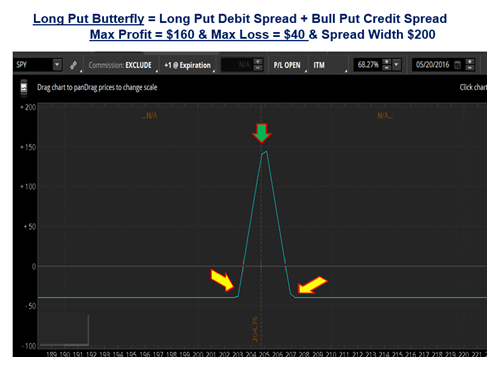

Long Call or Put Butterfly Spread

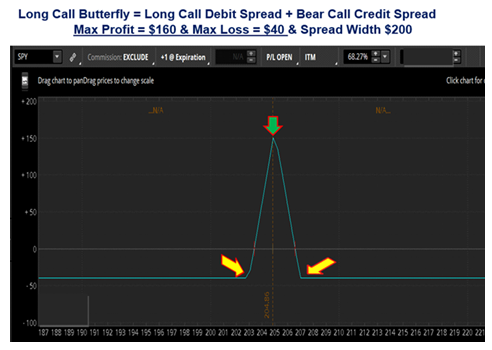

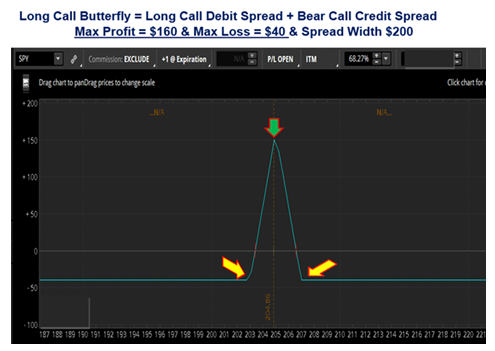

- It’s a combination of a bull call debit spread and a bear call credit spread

- It is a limited profit, limited risk options strategy

- There are 3 striking prices involved in a butterfly spread and it can be constructed using calls or puts

- Called a butterfly spread because you are short the body & long the wings

- Can be used as a neutral or directional option trading strategy

- Trade results in a small net debit & max risk is the debit paid

- Due to small net debit, this strategy offers a great risk-to-reward

- Short Volatility & Theta Strategy

- A target price pinning strategy

Max Profit

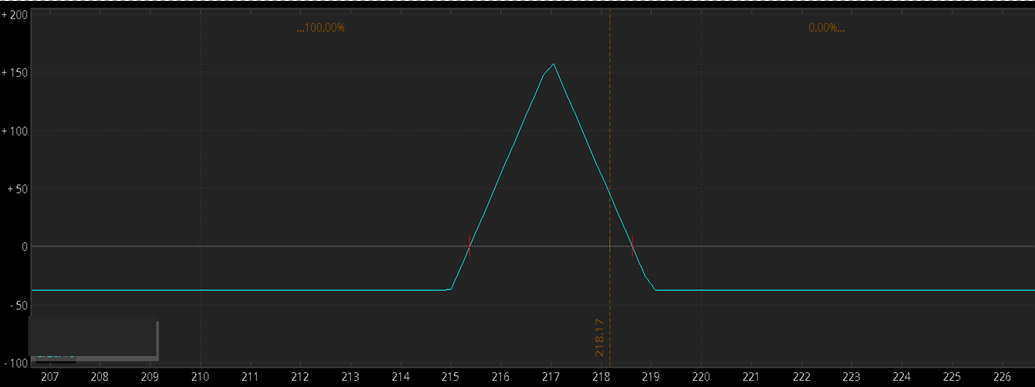

The maximum profit occurs should the underlying stock be at the middle strike or body at expiration.

In that case, the long call with the lower strike would be in-the-money and all the other options would expire worthless.

The profit would be the difference between the lower and middle strike (the wing and the body,) less the premium paid for initiating the position, if any.

Max Loss

The Maximum loss occurs should the underlying stock be outside the wings at expiration.

If the stock were below the lower strike all the options would expire worthless

If above the upper strike all the options would be exercised and offset each other for a zero profit.

In either case the premium paid to initiate the position would be lost.

Balanced Butterfly Spread Example:

Assuming xyz trading at $45 ~ Directional Price Target $43

Buy to Open 1 contract of August $44 Call at $1.06

Sell to Open (2) contracts of August $43 Call at $1.67

Buy to Open 1 contract of August $42 Call at $2.38

Net Debit = ($2.38 + $1.06) – (2x $1.67) x 100 = $10.00 per spread

Profit Calculation of Butterfly Spread:

Maximum Profit = (Middle Strike – Lower Strike – Net Debit) x 100

Assuming xyz closed at $43 at expiration.

Maximum Profit = $43 – $42 – $0.10 = $0.90 x 100 = $90.00 per spread

ROC = $90/$10 = 900% or R:R 9-to-1

Let’s review what was covered in this Presentation on The Option Butterfly:

I. Best Market Conditions for Butterflies

II. Benefits of Butterflies

III. The Option Greeks You Need to Know First

IV. The Most Important Option Factor

V. The Butterfly Setup

THE SPECIAL OFFER

If you would like to learn more about this chart pattern and my other favorites, along with the directional trading tools we use, at Power Cycle Trading then use the link below and you’ll receive one month access to our Power Cycle Trading Club for just $7.

Power Cycle Trading Club

Here is what you will receive:

- Virtual Trading room – Open from 9:25 AM until 4:15 PM EDT

- Daily Market Update Videos for Day Traders and Swing Traders

- Live Weekly Q&A with Larry

- Trader’s Education Vault

- Monthly Award Points – $20 credit for each month of membership. (Credits can be applied to all current or future courses)

- 50% Discounts on All Courses & Trading Software