The Winning Secret—doesn’t that sound good? Wouldn’t it be nice if you really did know a secret for making money that practically no one else knows?

If you are one of the few individuals who trade options the right way, you can literally create an income from anywhere in the world you choose. That kind of geographical freedom has never before been possible—and still isn’t for most.

The returns reported by many of our subscribers using the strategies you are about to learn range from 5% to 25% per week—that’s $1,000 to $5,000 per week on a $20,000 account.

If a person was using $100,000—perhaps in a retirement account—these percentage returns equate to incomes from $5,000 to $25,000 per week! And fortunately these strategies are not dependent on the economy thriving—or crashing—or remaining stable. All that is required is to follow the rules—which you will quickly learn.

The bottom line is you may be a lot closer to financial independence than you think—in fact you might be able to create it right now depending on the size of your account and your current overhead.

And that is a pretty inspiring thought.

Now what’s this stuff about a secret? Doesn’t everybody who trades options know how to create profits this way?

No—the truth is that most people who trade options concentrate on only one of two strategies—buying straight puts and calls, or selling calls on stocks they already own. VERY few people know what you are about to learn and even less practice these surprisingly effective techniques.

Interestingly, even though these strategies are very effective, oftentimes people still don’t practice them— apparently trading based on time decay is just too ‘boring’.

But as you’ll soon discover these strategies–and the returns that they generate–are anything but boring. Most folks however, are blinded by the potential for the ‘big win’–so they never will realize the truth of how effective these methods are—which is why we can honestly describe these techniques as a ‘secret’. This is especially true when you include our specialized tweaks you will never find in another options trading course—special approaches that turn a good strategy into a great one.

The trick is coming as close as possible to eliminating risk. Options trading gives you so much leverage that you can make money on even small moves in a stock price—the trick with options is keeping your profits because the big bad beast can giveth, and the big bad beast can taketh away – and does from most people an astounding amount of the time.

If you talk to enough options traders you’ll discover an alarming pattern—people make a whole bunch of money in a really short time and feel downright empowered—right up until they lose it all at breathtaking speed.

Often these folks get themselves to believe losing all their money was a fluke—so they eventually scrape a little trading capital back together and leap right back in.

Amazingly enough they are broke again within a few short months. So here’s a BIG secret hiding inside the very core of the Winning Secret –

An All-In-One Guide for Every Futures Trader

From basic futures trading background to complex strategies using options, Bollinger bands, Fibonacci sequences, and much more, this guide has something for every type of futures trader. Learn the basics or enhance your futures trading strategy with RJO Futures!

Download Your Complimentary Technical Analysis Guide TODAY!

Create an automatic mechanism that keeps you from losing.

In other words use a strategy that makes losing a VERY rare event. Now before you laugh and tell me to quit reciting the obvious, this is a super important point. The reason is, it is really easy to lose at options trading—which could be why so many otherwise competent people do exactly that.

The reason they lose is not because they are bad people or lazy or stupid or any other personal deficiency. The reason they lose is because they are using the wrong strategy.

The right way to approach every options trade is with the thought, “What is the worst that could happen?” and then prepare for that event—because as our old friend Murphy would say—“Anything bad that CAN happen, eventually WILL happen.”

What you don’t want to do is spend a lot of time and effort building up a really nice account and have it all swept away with one or two bad trades. A good chunk of this program is dedicated to preventing that from happening.

So, What the Heck is This ‘Secret’ and Why is it Winning?

The first part of our secret is obvious—we’re trading options and options give you so much leverage over stocks that you can really compress the amount of time it takes to create some serious weekly income—instead of a year to get 5% to 25% we’re talking about a week –that’s beyond huge.

It’s actually possible to compress fifty-two years of investing into just one year—for those of us close to retirement or those who don’t want to wait the rest of their lives to become financially independent, this advantage is life-changing.

The second part of our secret is not so obvious. In fact virtually one-hundred percent of the people who wash out their accounts and bad-mouth options trading for the rest of their lives never get the secret you are going to discover next.

Make One Simple Switch in Your Thinking…

And you will increase your chances of winning by up to 95%

The second part of our secret is simply this—if 80% to 95% of the people who lose money trading options are BUYERS of options—let’s jump on the other side of that fence and become SELLERS of options.

This breakthrough in thinking came for me on a chance encounter with a total stranger flying home from a business trip one dark, rain-driven night many years ago…

He was an older man–a tough and wealthy retired stockbroker, the kind of guy who has seen hundreds of fortunes made and lost in the markets. He knew a few tricks about making money and was willing to share some of them on that late flight years ago. I was amazed at the things he knew and listened intently—

Finally, after his second whiskey, he fixed me with an intense stare and growled in a low voice, “Son,” he said…

“You can either be a collector or a contributor in the stock market—which one do you want to be?”

That is an excellent question–unfortunately just ‘wanting’ to be a collector doesn’t make it so. You actually need to set up your trades so that you ARE a collector.

One of the neat things about options is, except for the bid/ask spread and commissions, options are a zero-sum game.

“Zero sum’ means no money is ever lost, it just changes hands—so if 80 to 90% of options buyers are losing money then if we become sellers we shouldn’t we be winning 80% to 95% of the time?

You know what’s great? That is exactly how the percentages work out in the real world—and with a few little known tricks those percentages can get even better.

We will literally be collecting the money the options speculators are betting when they buy calls or puts—and statistics tell us that when expiration day rolls around— once every week—-we’ll be keeping that money 80 to 95% of the time.

So The Winning Secret in its simplest form is—Become an options seller instead of a buyer.

Once you make that very important decision you can spend the rest of your time figuring out how to become a very competent seller of options—the kind who always goes for maximum profits with minimum risk.

One of the ways we’re going to do that is to generate those profits on a weekly basis so you’ll get the best part of a job—the monthly paycheck—without actually having to go to a job.

And to do that we’re going to get some really strong guys in togas to help us break through the wall keeping us from consistent profits.

Our first helper is a big powerful Greek—and he regularly makes mincemeat out of speculative options traders.

His name is Theta.

How to Turn the Biggest Bully in Options Trading into Your New Best Friend

Walk the toughest neighborhood in confidence with this guy by your side.

Do you know what the biggest bully in options trading is?

As the comedians love to demonstrate—“It’s all about Timing”. The problem is, traders are rarely laughing when their options run out of time before they can appreciate to profitability.

Options are time-sensitive, so options buyers not only have to guess the direction of the stock correctly—they have to guess the amount of time the move is going to take as well.

And if the buyer is off on their ‘guesstiment’—they lose—all the money they had in that trade—to the person that sold them their option in the first place.

So the biggest bully in options trading for options buyers is time—something the options mathematicians call theta.

This theta can be quite the Olympic athlete—it can often be seen running through the hour-glass seemingly going faster and faster with the expiration day finish line looming larger and larger—until there is no more time left.

Theta has crossed the finish line, and more often than not, it’s the options seller who collects the prize.

Here is a fact you might enjoy contemplating: More people have lost more money because of their options running out of time than any other factor.

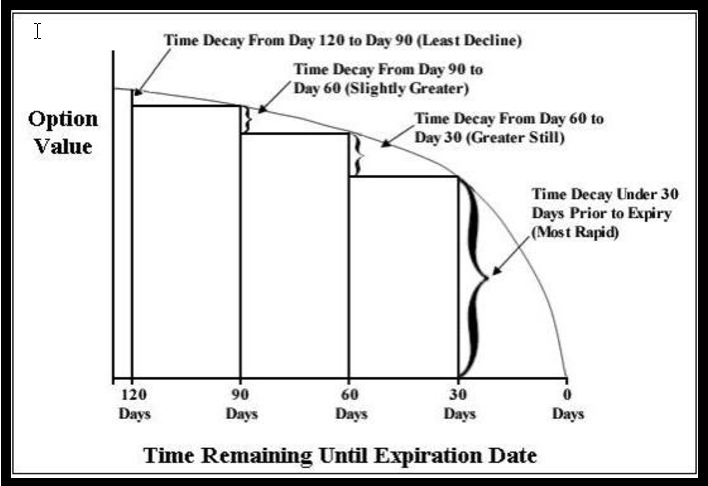

Options time decay actually accelerates as the option gets closer to expiration.

But since we already know there are two sides to this story we could also make a much more inspiring statement:

More people have MADE more money by options running out of time than any other factor.

How can BOTH statements be true? Simple—the first statement refers to options BUYERS, and the second refers to options SELLERS.

So—to paraphrase that old stock broker I sat next to on a late night flight so many years ago—which one do you want to be?

The amazingly ironic thing about this fact is that almost the entire world of options trading advisories are all trying to get you to become a buyer of options. The reason is

because they can tout such huge returns when the trades go right—100%, 200% even 300% returns are blazoned across their advertisements.

What they don’t tell you is when you lose you can easily wipe out your whole account in a few trades—and believe me it happens—to a whole bunch of people all the time.

In fact if you are an options buyer it’s simply a matter of time. It’s like playing Russian Roulette—you might skate by five times out of six, but that sixth time is a killer—literally. The silver lining of this harsh fact is to become an options seller—and that is what we’ll be.

THE SPECIAL OFFER

To see exactly how to do that for maximum fun and profits–I’ve prepared a special one hour course that could be the most inspiring financial information you’ve ever seen–and you can now access it for FREE by clicking below.