By Mark Shawzin, The PatternTrader.com

After spending 23 years trading for 8 different Wall Street firms, there is one simple truth I’ve learned.

There are no true “trading secrets” out there.

Here’s how it works on Wall Street:

For example, in 1987 I worked for Bridgewater & Associates in The World Trade Center, when Black Monday wiped out the Dow Jones.

Most of Wall Street went into a severe panic attack.

Yet one obscure strategy predicted the top of the stock market with crystal ball-like accuracy.

A guy called Paul Tudor Jones executed it like a sniper taking out its target and floated away with $100 million in just 24 hours.

PBS giddily released a documentary about him. Jones was both furious and terrified when the release date came due. He ended up buying every single copy and stopped them from printing any more film, fearing his secrets would be revealed.

Unfortunately for him, Wall Street is worse than The Real Housewives of Beverly Hills (nothing stays secret for long).

From 1992 to 1996 two data scientists from the University of Pittsburgh (Caginalp and Laurent) tested six “secret” entry methods… two of them would have predicted the top of the 1987 Black Monday crash.

They submitted their results to the Applied Mathematical Finance journal. For two painstaking years, data scientists pored over their results.

Finally, their earth-shattering findings were accepted, approved, and published in 1998.

The contents of this study were explosive. They reluctantly proved that it is possible to pull huge chunks of money out of the markets with a simple 3-bar formation that has a tendency to accurately predict when a market is about to reverse. Based on nothing but price.

No indicators, no analysts, no big news events, no underlying earnings reports, no industry growth numbers… just the formation of a few price bars.

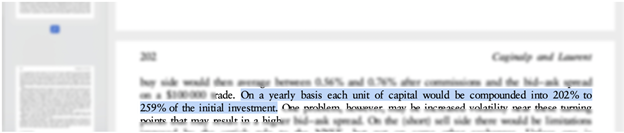

In their paper they state,

“...a trader who has the same information as others plus the knowledge of this method will have a competitive advantage… On a yearly basis each unit of capital would be compounded into 202% to 259% of the initial investment.”

If you had invested $5,000, you would end up with $15,100 after one year, $45,602 after two years, and $137,718.04 after just 36 short months!

Here’s why these matters to you today in 2021 (over two decades later):

This scientific paper led to an orgy of research into this stupidly simple trading strategy.

Naturally, people were skeptical.

“But what about other markets? And other market conditions?”

The stampede to disprove this strategy started with two other math geniuses (Yung-Ming Shiu and Tsung-Hsun Lu) who tested it in the Taiwan stock market from 1998 to 2007.

They not only agreed with the results of our boys from Pittsburgh University, but they also actually compared a boatload of other strategies. Their conclusion?

“[...]This strategy is more frequent and most trustworthy according to our results.”

One by one, more studies came out. They are STILL testing it every few years. There have been 150 follow up research papers since Caginalp and Laurent published that first one.

Here are more recent examples.

In 2018 the International Journal of Economics and Business Research, published a scientific paper by Chin et al, testing this method in the Malaysian Stock Market.

Later that same year, the Journal of Insurance and Financial Management published a peer reviewed paper that proved it worked in the Vietnamese Stock Market.

Two other researchers from India, Prasad and Murugaiah, tested it in the Indian Stock Market and published their results in an investment journal called Wealth.

There have been four new studies hot-off-the-press in 2021 alone.

That’s true evidence.

This weird and wonderful strategy turned from hot gossip into a bankable scientific fact.

It came in handy once...

After 23 years on Wall Street, I got thrown out, effectively banned from trading for big institutions, and left nearly penniless, with a newborn son on the way.

I was completely on my own.

For nine years the SEC dragged me from one deposition to another for “insider trading.” I spent my life savings defending my name.

The small fortune I made trading on Wall Street wasn’t enough.

They broke me. It was like dying from one-thousand papercuts over the better part of a decade.

I told them outright, “I’ve got nothing left. No lawyers, no money, and no energy to fight on.”

I was willing to go to court with a dreary public defender. I flat-out refused to confess to a blatant lie. But it didn’t come to that.

It turns out… they had no evidence! Zilch. Nada.

Why?

Because I didn’t make any money from the alleged “insider information.”

To get charged with insider trading there had to be some money that was made on that info.

There wasn’t. So, the case was dead.

I signed some form that said, “I neither admit nor deny guilt”. And the whole thing was over. Or so I thought.

The sad consequence of this was that nobody on Wall Street would touch me.

My name had been dragged through the thick mud of the SEC.

I went from a hot commodity in Lower Manhattan to an “undesirable” ...

Like I said… I was on my own. I had to make money, or my new family would starve.

I took the few dollars I had left and became a small-time investor - using the exact same cash generating strategies I used when I was considered a “Shark” on Wall Street.

In fact, the simple method tested by the two data scientists from Pittsburgh became my main money-making tool.

Because…

And in 2021 this strategy has continued its astonishing streak of record profits.

Here’s the best way I’ve found to understand it:

Think of the trade selection process as a “gauntlet” - a harrowing Trial by Fire challenge that only the most profitable trades can survive.

I have broken down this workshop into a series of “checkpoints”.

CHECKPOINT #1: Trade the Market With “Explosive Energy”

If you’re going long, you don’t just want a market to hobble upwards, struggling with every breath, to get to the top. You want it to shoot out like a cannonball.

And if you’re going short, you want the floor ripped out from underneath it as it hurtles toward oblivion.

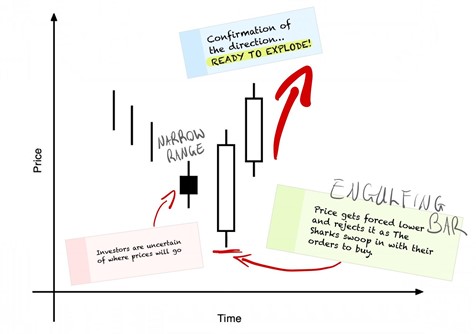

Here’s how it works: Before a Godzilla-like move in price, you need a buildup of “energy”. The more people who are looking at a currency/stock/or metal, and interested in a particular direction, the more pent-up energy the market has.

What it means is this: If you can spot this buildup of energy, you can buy a cheap ticket to board the profit-train before it shoots off like a bullet.

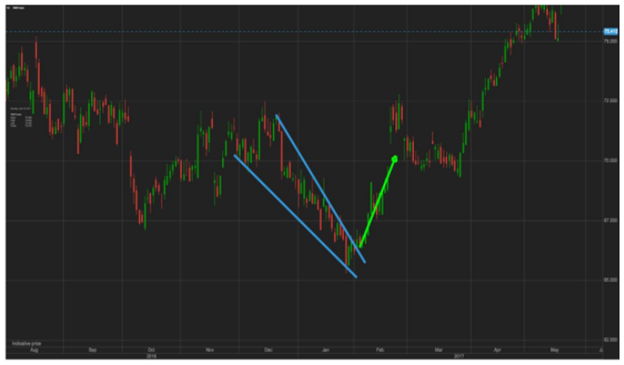

There are exactly 8 chart patterns that have been scientifically tested and accepted into the literature that help you to spot these pockets of energy.

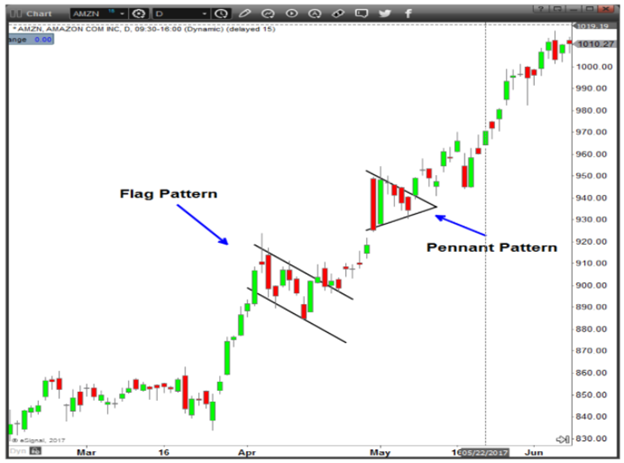

Here is one of the eight:

However, this will only tell you where the market is most likely to go in the next few days…

I want you to execute trades that will continue to produce profits for weeks and sometimes months.

Which is why the next step is…

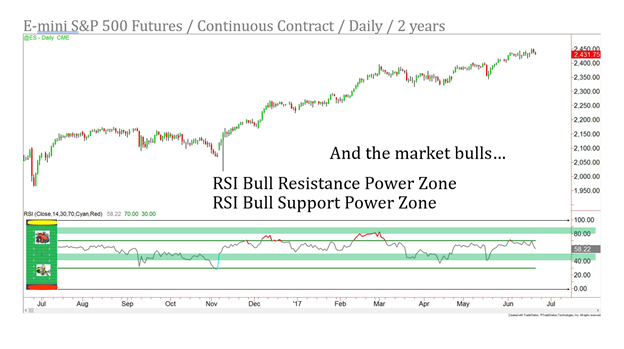

CHECKPOINT #2: Pick the Most Likely Direction For The Next 100 Days

If there is a “secret sauce” to this recipe then this would probably be it.

You’ll be able to get in early, generate some cash in the initial “explosive” move (as described above), and then hitch a ride on a multi-week journey of stunning profits.

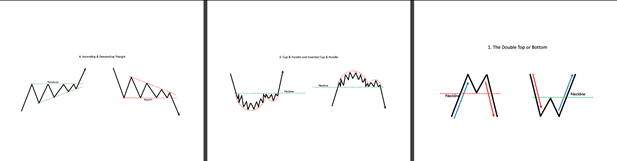

There was a collaboration of epic proportions between three universities (University of Nebraska-Lincoln, University of Iowa, & Creighton University).

They looked at four long term chart patterns, decades of market data, and painstakingly waded through one trading scenario after another.

Every time one of these patterns occurred, they would plot the exact path that price took afterwards.

They repeated this process 35,000 times!

...And layered every single one of those scenarios on top of each other.

It turns out that markets follow a predictable path once these patterns occur. A path that you can use to rapidly top up your investment account with found money. It’s kind of like following a map that leads you to a small handful of profitable trades every month.

Here are three of the patterns that were tested. You can only use them as a confirmation of the direction… you cannot enter the trade yet.

This gauntlet is strict. Once those first two checkpoints have been satisfied I need...

CHECKPOINT #3: Let The Market “Confirm” Your Entry

After all the analysis… after the scientific “coil” of energy AND the scientifically tested long term governing pattern you don’t just pile in mindlessly.

Instead, you set up a pending order outside of the chaos. Waiting patiently for the market to knock you into the trade.

There is no need to stare at the charts, agonizing over whether a trade is “correct” or not. No need to second guess yourself or worry that you did something wrong.

The best thing for you to do is to see this strategy in action.

THE SPECIAL OFFER

That’s why I would like to invite you to…

Get Instant Access To The Scientific Trading Formula Course PLUS Join Me Live In The Markets For 4 Days As I Execute This Exact Strategy In Front Of Your Eyes

This is ideal for you if you finally want to experience something that’s truly amazing.

Look, this 4-day event is live. It isn’t a newsletter. It isn’t someone’s “written opinion.”

The easiest way to tell if someone is 100% genuine of what he’s saying is to ask him to put money on it - and to do it in front of a live audience.

Get started here for a refundable $27.

(During the live event I will send proceeds to The American Childhood Cancer Organization).

Don’t forget, as well as the live event you’ll also get instant access to a quick to consume 3-module trading course called The Scientific Trading Formula that’ll allow you to use a rigorously tested method to spot a small handful of trades every month.

Author: Mark Shawzin

Company: The Pattern Trader

Websites: ThePatternTrader.com

Services Offered: Scientifically backed trading education

DISCLAIMER

"This eBook is for information purposes only. Any products or services offered or recommended are not endorsed by OptionPub and neither the company nor its affiliates bear responsibility or control over the content of the information and the product or service offered. There is a very high degree of risk involved in trading. Past performance is not indicative of future results. The profits and performance shown are not typical, we make no future earnings claims, and you may lose money. OptionPub and all individuals affiliated with this site assume no responsibility for your trading and investment results. The indicators, strategies, columns, articles and all other features are strictly for communication purposes only and should not be construed as investment advice. Information for any trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. Your information may be shared with our educational partners. You must assess the risk of any trade with your licensed investment professional and make your own independent decisions regarding any securities or investments mentioned herein. Affiliates of OptionPub may have a position or effect transactions in the securities or investments described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies."

By Dr. Barry Burns, TopDogTrading.com

There are many risk management techniques in trading. Some use complicated mathematical models. Others use a combination of art and science.

There’s no one answer to the question of how to manage your risk, other than to use principles that allow you to CONSISTENTLY keep your losses small and try to catch big winners when they occur.

Amateurs are always looking for successful trades. Their expectation is that each trade they place is going to be a big winner. If you ask them this, they of course say “no.” But when you watch their behavior, the answer is clearly “yes.”

How does this manifest itself?

When a trader takes multiple trades over time, but none of their trades turn into large winners, they get tired, get distracted and take a break, skip some trades, and miss the potential big winner.

Beyond simple fatigue, this happens in part because of the trader’s belief that most of their trades should be large winners if the trading method is valid.

Another phenomena that occurs is that after so many small wins, small losses and break even trades, the trader gets enamored with a small or medium size profit, so locks that in before the market has finished its move. Then the market goes into a mega-trend without him/her.

The truth is that most trades taken by successful traders I've seen are small wins and small losses. A good day trader may find that 1-3 of their trades for an entire week account for 80% of their profits for that week. That means 2-4 days with no significant winning trades.

There’s simply no way to know when the market is going to have a major follow-though, so you have to take every setup in your methodology without getting tired. Knowing this before you begin gives you the proper mindset to be consistent, not miss trades, and not be concerned when most trades don’t follow through very much.

It also encourages you to look for those opportunities to hang on to winners when they do occur, because you know that’s where your entire weekly income may be found.

Most traders are aware of the need to trade with a good risk/reward ratio. However the truth is there’s no way to assure that on any one trade. Your risk/reward ratio is established over a history of trading.

You can’t control when or whether the market makes a big move, so you must focus on keeping your risk consistently small.

Again, many traders don’t keep their original risk consistent. This is absolutely crucial, otherwise some losses will be large and others will be small when your protective stop is triggered. This is a recipe for disaster.

When I refer to your protective stops being consistent, there are often 2 misunderstandings that arise:

1. You’re supposed to trade the same number of shares/contracts every time.

2. You’re supposed to trade the same amount of money each time.

Let’s look at #1 first: You’re supposed to trade the same number of shares/contracts every time.

If you trade 100 shares on every stock, then on a $10 stock you’re investing (putting at risk) $1,000, and on a $100 stock you’re putting at risk $10,000. These are not equal risks. Therefore you’re giving one trade much more weight in your portfolio than the other. This is terrible risk management. 75% of your trades could be winners, but if all your winners are with $10 stocks and all your losers are with $100 stocks, you’re still likely to lose money.

Now let’s look at #2: You’re supposed to trade the same amount of money each time.

You may think to solve this problem you’ll simply invest the same amount of money in each stock. So if you decide you’re going to invest $1,000 in each stock, you would buy 100 shares of a $10 stock, but you would buy 10 shares of a $100 stock.

This certainly could be a reasonable approach in that you’re risking the same amount of money on every trade.

But there is one shortcoming to that approach. It assumes that your risk is the ENTIRE position.

It’s true that when you put that money out there, the entire position IS indeed at risk. No question about that. However, what is the probability that your stock will go all the way down to ZERO overnight?

If you’re trading stocks that have decent volume and price (avoiding penny stocks and lightly traded stocks), then that risk is minimal (though we acknowledge that it’s always there).

Here’s the problem:

Your actual risk on 99% of your trades should be only the distance between your entry and your protective stop. But that distance will often vary by as much as 50%. That means your risk on the vast majority of your trades will vary by as much as 50%.

This is the more typical scenario.

Therefore the approach that will level the risk on all your trades is to take the amount you’re willing to risk on a trade and divide that by the distance from your entry to your protective stop.

EXAMPLE:

You’re willing to risk $300 on a trade.

If the distance from your entry to your protective stop is $1, then you could buy 300 shares. If the distance from your entry to your protective stop is 50 cents, then you could buy 600 shares.

It also helps to look at your “budget” and set a maximum amount you will risk if the stock does go to zero. This means keeping the stocks you buy in a certain price range and not risking more than a set percentage of your total trading account (usually 2% or less) in total investment on any given trade. This helps to buffer you from the occasional stock that gaps through your stop or goes out of business. And, of course, solid diversification principles and hedging with options are also critically important.

If you’re not already familiar with these principles, I encourage you to get a book on risk management since the topic is beyond the scope of this article.

Another key aspect of managing risk is what I call “adjusting your cost position” in the trade as soon as possible. In addition to keeping your protective stops, this is a way of keeping all of your losses small.

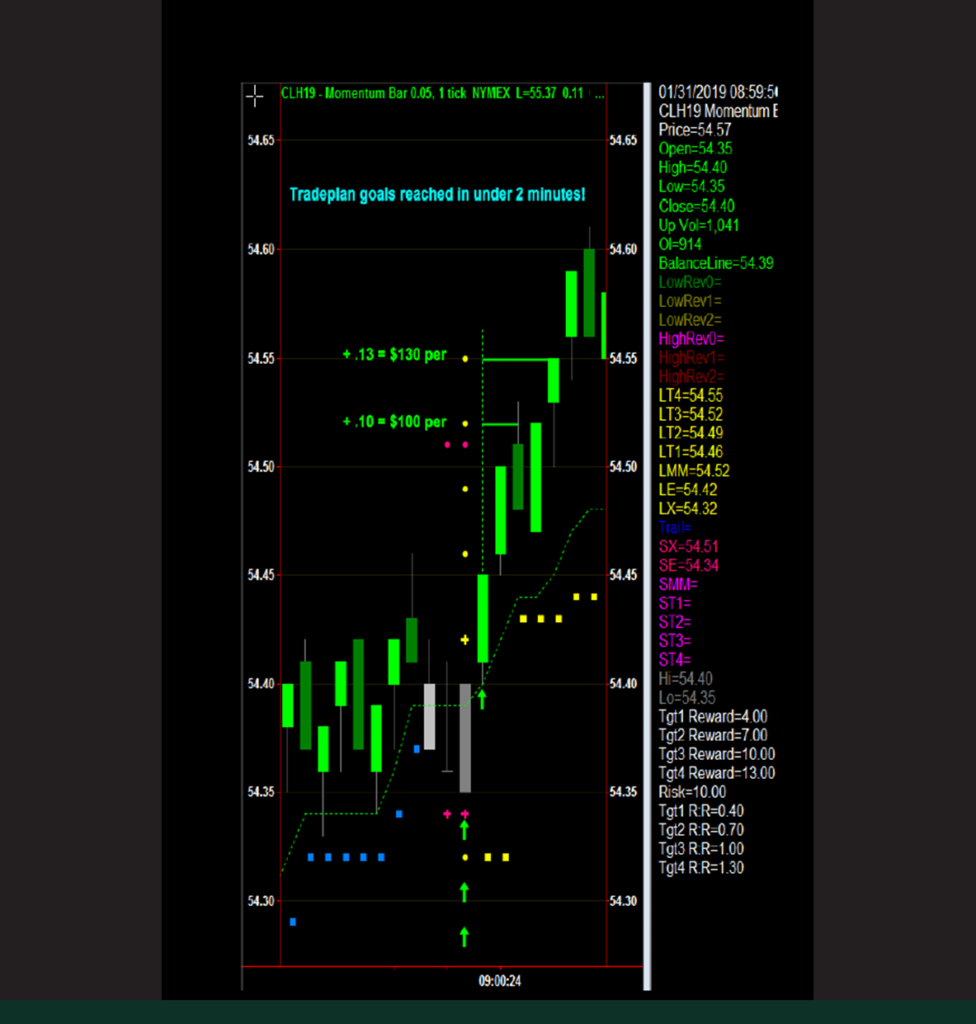

I’ll demonstrate this with an example of day trading the e-mini, but it also applies to stocks, Forex, and commodities, as well as swing trading and investing.

In the example below we’re going SHORT below the low of the setup bar (highlighted) and putting our stop above the setup bar. The exact reason for entering the trade isn’t important, we’re just using this to illustrate money management.

We’re risking 6 ticks and trading 4 contracts, so our total risk in the trade would be $300 if the trade completely fails and we get stopped out.

We could use the last swing low as our first target. That would be 1422.00 and would give us more than a 1:1 risk/reward on the first exit, which would be great … if we reached it.

The trade didn’t work, so we lose $300. Don’t you hate when that happens?

If we simply used a strict 1:1 risk/reward for our first exit, that wouldn’t have worked either since price just tickled 1422.75, which was 1.5 points from our entry and exactly a 1:1 risk/reward, but the odds of getting filled were small.

We risked 6 ticks, but instead of insisting on a 1:1 risk/reward, what if we took off ½ of our position earlier, at only a 4 tick gain? Now let’s see how that would change things.

First, the closer you make your first target and the quicker you take profits, the greater your odds that you’ll hit your first target. The risk/reward isn’t as good, but the win/loss on the first exit will be much greater. Getting a 1:1 risk/reward is much harder than most people realize until they try getting it. The odds are generally lower than 50/50!

So if we put our first target at just 4 ticks, then we have a bad risk/reward, but a much better win/loss. Remember, this is only the target for part of our position … say the first 2 contracts.

Now let’s look at the math on the last trade:

The difference in your losses is HUGE!

Here’s the rub:

The FIRST RULE OF TRADING is “keep your losses small.” And this is one way to try to do it.

The primary objection to this approach is:

This reduces your risk/reward ratio because you’re removing fully ½ of your contracts with such a puny profit.

That is absolutely true. If you have a solid trading methodology AND you have the psychological makeup to take many more losses than wins, BUT you also have the psychological makeup to hold on to your winners for the big payoff, then go for it!

But most people can’t handle the large draw down periods of such an approach, so whether it “works” or not isn’t helpful, because most traders can’t “work” it.

However you need to understand the point of this technique. Those first 2 contracts are there for the exclusive purpose of reducing the size of your losses. They are purely defensive. Therefore even taking a 1 or 2 tick profit on them will help reduce your loss.

They are only used to “adjust your cost position” in the trade. They are there to acknowledge that many trades do not succeed, so we simply want to minimize the damage of the losing trades.

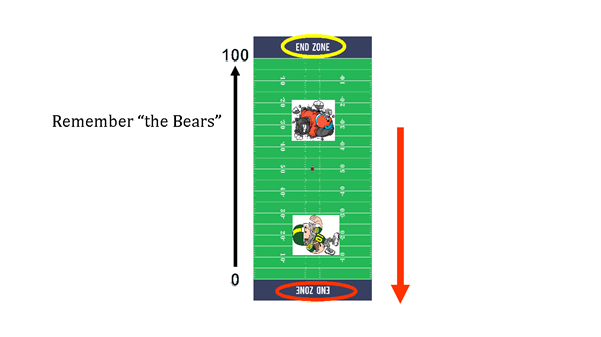

They are your defensive players whose job it is to simply hold the other team from scoring too many points against you until your offense can come back on the field and score some points for your team.

And it works for one very good reason: The probability of the market moving 2-4 ticks in your direction are much higher than it moving 4-8 ticks in your direction.

Then you still have 2 contracts left in case the trade actually works! You have a 3rd contract to use for medium profits and a 4th contract to use with a trailing stop to catch the big winners.

This money management trick is a combination of scalping and position trading to help you get the best of both worlds.

Mature and successful traders tend to be impatient with their trades at the beginning because they know from experience that many of them are not going to work out. So they tend to emphasize defense more than offense. Amateurs, on the other hand, tend to be overly optimistic about trading in general, and so tend to emphasize offense more than defense.

THE SPECIAL OFFER

Get one of my favorite trading strategies, "The Rubber Band Trade" by clicking on the button below.

Author: Dr. Barry Burns

Company: Top Dog Trading

Websites: TopDogTrading.com

Services Offered: Trading Education, Free Videos, Books

Markets Covered: Stocks, Options, Futures

DISCLAIMER

"This eBook is for information purposes only. Any products or services offered or recommended are not endorsed by OptionPub and neither the company nor its affiliates bear responsibility or control over the content of the information and the product or service offered. There is a very high degree of risk involved in trading. Past performance is not indicative of future results. The profits and performance shown are not typical, we make no future earnings claims, and you may lose money. OptionPub and all individuals affiliated with this site assume no responsibility for your trading and investment results. The indicators, strategies, columns, articles and all other features are strictly for communication purposes only and should not be construed as investment advice. Information for any trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. Your information may be shared with our educational partners. You must assess the risk of any trade with your licensed investment professional and make your own independent decisions regarding any securities or investments mentioned herein. Affiliates of OptionPub may have a position or effect transactions in the securities or investments described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies."

By lawrence McMillan, McMillanAsset.com

The concept of momentum trading has been a powerful force in the markets over the past few years. The traditional concept is that a momentum trader identifies a stock that has already begun to move strongly and trades with the momentum. That is, if the stock is roaring up, momentum traders jump in and buy the stock – attempting to quickly ride it to even higher prices, and perhaps adding to the momentum with their own buying. Similar things can happen on the downside. Some momentum traders will only try to capture a small profit – perhaps just a fraction of a point for some day traders – while others will try to stay in the “hot” stocks until they lose their momentum completely. Those decisions are personal ones that each trader must make for himself – deciding whether he wants to trade for fractions or assume greater risk and try for greater rewards.

The key to this sort of trading is to be able to identify the momentum stocks with some degree of confidence. The trend following method described below has a good track record of success. Since we tend to hold onto our intermediate-term recommendations, preferring to try to let profits run until we are stopped out, we are going to take the viewpoint of buying and holding these momentum trades until they show some signs of weakness.

A proven way of trading momentum is to get on a trend and stay with it. This system, described in full in the book, Street Smarts, by Linda Raschke and Larry O’Connor, is called the “holy grail” (tongue-in-cheek, of course, since there is no real holy grail). It’s quite simple, really – as many good systems are. Philosophically, the system is this:

1) find a market (stock, index, futures) that is trending

2) wait for it to pull back to support

3) buy it when the trend resumes.

Specifically, one must use the following items of technical analysis to implement the system. This implementation is very similar to Linda’s, but I have introduced a couple of small changes which reflect the way that I personally use this system:

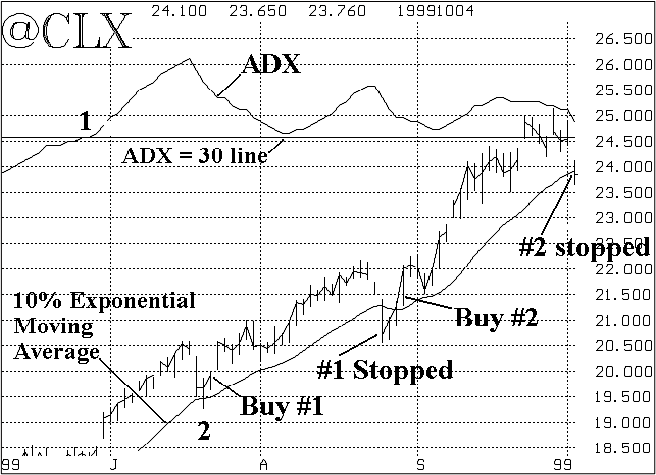

In order to explain this concept, we’ll use a “classic” example.

The chart above shows November Crude Oil (symbol: @CLX) when it was trending strongly. First, look near the top of the chart, where ADX is drawn. The straight line indicates an ADX of 30 (there is no scale for ADX on the chart, so this “30 line” is one’s only point of reference). You can see that ADX rose above the 30 line at the point marked “1" on the chart, and stayed there for the rest of the summer. So, by definition, Crude Oil was in a trending mode all summer. By inspection, the trend was up. This satisfies the first criterion: ADX >= 30.

On the rest of the chart, the price chart of @CLX is drawn, along with its 10% exponential moving average. The first point of interest is directly above the point marked as “2". That is where @CLX – which was trending upward at the time because ADX was greater than 30 – fell back and touched the 10% exponential moving average line. This satisfied criterion 2, and a setup was established.

The actual buy (Buy #1) took place the next day when @CLX traded above the high of the day marked as “2". This buy #1 took place at a price of about 19.85. At this time, one would buy the @CLX futures (or options, if you prefer). The initial stop would be set below the low of the day marked as “2" – at 19.20. That particular stop never came into play because prices rose.

Eventually, the buy was stopped out when @CLX closed below its 10% exponential MA about a month later (at the point marked as “#1 Stopped”). The sale came at a price of 20.67 – a profit of 82 cents on this trade.

Interestingly, even though the position was stopped out, ADX was still above 30, so another setup was simultaneously created (ADX was still above 30, and @CLX had pulled back and touched the exponential MA). So, three days later when @CLX traded above the high of the day it was stopped out, Buy #2 occurred – at a price of about 21.40. The stop for this new trade was initially set at 20.50 – just below the low of the bar that touched the moving average. It never came into play, however.

This second buy was even better than the first, with the trend resuming in earnest – carrying prices above the $25 level in Crude before pulling back suddenly and stopping out the position at 23.76 (at the point marked “#2 stopped”) – the last bar on the chart.

This system can be used for stocks and sector indices as well. Potential profits may be quite large if a long trend ensues, and risk is defined within a fairly small amount as designed in the stop criteria outlined above. Momentum trading recommendations are made most frequently in our daily publication, The Daily Strategist, but are sometimes included in The Option Strategist as well.

THE SPECIAL OFFER

Get a free 30-day trial to my flagship advisory service, The Option Strategist Newsletter.

Scroll to the bottom, click the “ADD TO CART” button ($28.75) and enter the Coupon Code TPFREE at checkout. No credit card is required. Subscription will not automatically renew upon completion.

Author: Lawrence McMillan, Founder

Company: McMillan Asset Management

Websites: McMillanAsset.com

Services Offered: Trading Education, Account Management Services

Markets Covered: Stocks, Options

DISCLAIMER

"This eBook is for information purposes only. Any products or services offered or recommended are not endorsed by OptionPub and neither the company nor its affiliates bear responsibility or control over the content of the information and the product or service offered. There is a very high degree of risk involved in trading. Past performance is not indicative of future results. The profits and performance shown are not typical, we make no future earnings claims, and you may lose money. OptionPub and all individuals affiliated with this site assume no responsibility for your trading and investment results. The indicators, strategies, columns, articles and all other features are strictly for communication purposes only and should not be construed as investment advice. Information for any trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. Your information may be shared with our educational partners. You must assess the risk of any trade with your licensed investment professional and make your own independent decisions regarding any securities or investments mentioned herein. Affiliates of OptionPub may have a position or effect transactions in the securities or investments described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies."

By Rick Saddler, HitAndRunCandlesticks.com

Have you ever heard "There's no such thing as a free lunch."? That may be true, but I’m here to prove there are some exceptions.

In this short video, I am going to share my favorite chart setup, indicators and Rally-Pullback Strategy that can be used to trade the markets in any timeframe.

I am also going to share how you can get free 30-day access to my Trader Vision 20/20 services. Check out the SPECIAL OFFER below to learn more about this incredible program

SHORT VIDEO PRESENTATION: MY FAVORITE RALLY AND PULLBACK STRATEGY

THE SPECIAL OFFER

To find out more about the The Road to Wealth and other patterns we use in the Hit and Run Candlesticks and Right Way Options Trading Rooms on a daily basis, join us for a 30-day free trial to both rooms. The Hit and Run Candlesticks Trading Room is open Monday through Friday 9:00am to 4:00pm ET and Right Way Options Trading Room is open Monday through Friday 11:00am to 1:00pm ET.

Author: Rick Saddler, Founder

Company: Hit and Run Candlesticks

Websites: HitAndRunCandlesticks.com

Services Offered: Live Trading Room, Trading Education, Software

Markets Covered: Options, Futures, Stocks

DISCLAIMER

"This eBook is for information purposes only. Any products or services offered or recommended are not endorsed by OptionPub and neither the company nor its affiliates bear responsibility or control over the content of the information and the product or service offered. There is a very high degree of risk involved in trading. Past performance is not indicative of future results. The profits and performance shown are not typical, we make no future earnings claims, and you may lose money. OptionPub and all individuals affiliated with this site assume no responsibility for your trading and investment results. The indicators, strategies, columns, articles and all other features are strictly for communication purposes only and should not be construed as investment advice. Information for any trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. Your information may be shared with our educational partners. You must assess the risk of any trade with your licensed investment professional and make your own independent decisions regarding any securities or investments mentioned herein. Affiliates of OptionPub may have a position or effect transactions in the securities or investments described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies."

By Richard krugel, PriceActionAndIncome.com

Are you sick of second-guessing your analysis? Or worse, putting in the hard work and following your strategy rules only to see your trades crash and burn before they reach your targets?

When most traders start out, they tend to believe that the more indicators they use the better their performance will be…

But this couldn’t be further from the truth!

Instead, a better place to start is to understand how markets move on a chart and WHY – without any indicators.

SHORT VIDEO PRESENTATION - Using Pitchforks to Spot Quality Entries and Exits

THE SPECIAL OFFER

Market Geometry Toolbox

The Market Geometry Toolbox is like a "Greatest Hits" collection of trading tools.

It's a complete package for analyzing the markets just like I do, and it includes every analytical tool that I use to trade the markets, all pre-loaded with my custom settings and exact specifications for using them effectively to find massive opportunities in a freely traded market.

Author: Richard Krugel

Company: Price Action

Websites: priceactionandincome.com

Services Offered: Training Courses and Trade Alerts

Markets Covered: Forex. Futures, Options

DISCLAIMER

"This eBook is for information purposes only. Any products or services offered or recommended are not endorsed by OptionPub and neither the company nor its affiliates bear responsibility or control over the content of the information and the product or service offered. There is a very high degree of risk involved in trading. Past performance is not indicative of future results. The profits and performance shown are not typical, we make no future earnings claims, and you may lose money. OptionPub and all individuals affiliated with this site assume no responsibility for your trading and investment results. The indicators, strategies, columns, articles and all other features are strictly for communication purposes only and should not be construed as investment advice. Information for any trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. Your information may be shared with our educational partners. You must assess the risk of any trade with your licensed investment professional and make your own independent decisions regarding any securities or investments mentioned herein. Affiliates of OptionPub may have a position or effect transactions in the securities or investments described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies."

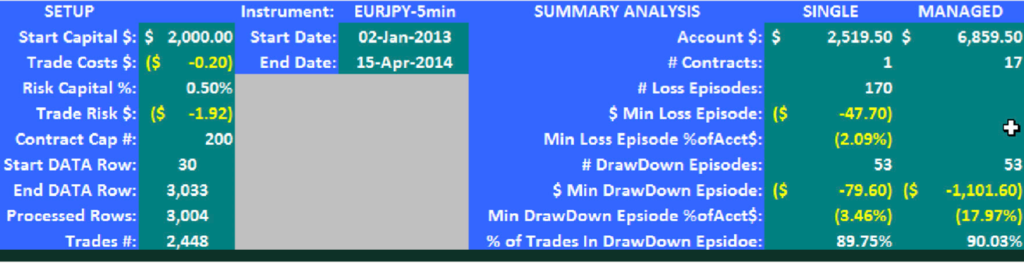

By Jeff Tomkins and Daniel Sinnig, ZillionTree.com

Have you ever wondered if trading indicators do more harm than good for traders? It’s a sensitive subject because most active traders and investors use indicators for technical trading. Using indicators is one best practice to identify high-probability trade entry and exit points. That is, if you are using them correctly. Trading Indicators are based on mathematical calculations which interpret different market properties like trend, momentum, volatility, and volume. Used correctly and you’re a hero. Used incorrectly, and it could spell disaster!

It can be daunting to know which indicators to use – are the settings ideal for your trading style and are market conditions ripe for your blend of indicators? Traders of all experience levels and backgrounds have risked their hard-earned money trying to find the Holy Grail of Indicators. We are not saying that we have found the Holy Grail, but we have found a couple of indicators when used together, gets us close. Our team of experts has spent many years researching, developing, and testing two of our most powerful proprietary indicators that are complementary and give outstanding results when combined. Before we reveal what they are, let’s talk about what makes them so effective.

What is Momentum and Trend Analysis?

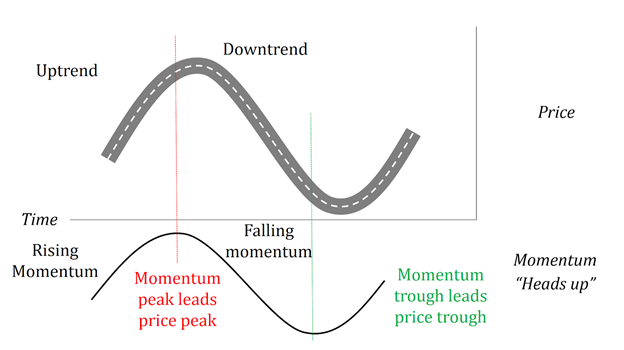

Linear momentum is one of the most reliable ways to predict a security’s future price. Whether it is a stock, exchange traded fund (ETF), index, futures contract or Forex pair, momentum tells us who is in control – the bulls or the bears. It gives us a reliable indicator of which way the market is headed and when a new trend is setting in or an old trend is reversing. Imagine having access to this knowledge before placing your next trade. In this article, we will explain how you can accurately gauge future market direction and place more confident trades in any market and any timeframe.

First, let’s examine what linear momentum is and how it exhibits predictive qualities in the markets. In physics, linear momentum is defined as the product of a system's mass multiplied by its velocity. The greater an object's mass or velocity, the greater its momentum. When applied to the markets, we can replace the variable “mass” with the catalyst of buying and selling pressure. Once we determine whether buyers or sellers are moving prices, we can more confidently place our trades and try to stay on the right side of the predominant trend.

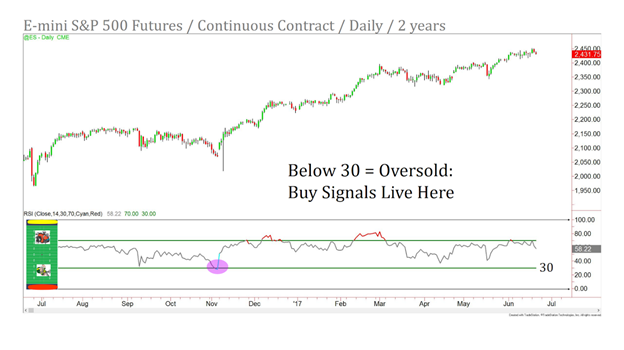

There are dozens of “momentum indicators” available on today’s retail trading platforms. Some are potentially more reliable than others. There are also many ways to interpret the data from these indicators and implement the output when placing a trade or incorporating the information into a trading system. Ultimately, we want a momentum indicator that tells us the strength, direction, momentum and duration of the trend in a security’s price. There is one particular indicator available on virtually any retail trading platform that does an incredible job at accomplishing all of these metrics: the MACD.

The MACD indicator, which stands for Moving Average Convergence/Divergence, is a trading indicator originally created in the late 1970s by Gerald Appel and used in the technical analysis of security prices. Appel designed this indicator to reveal changes in the strength, direction, momentum, and duration of a trend in a stock's price. Not only is this indicator accurate and versatile, but it can be applied to any market and any timeframe the trader chooses. While there are numerous ways to apply this momentum indicator, such as the identification of overbought/oversold conditions, one of the most reliable techniques to determine future trend momentum is the MACD cross.

The MACD is comprised of a 26-period Exponential Moving Average (EMA) and a 12-period EMA. By subtracting the 26-period EMA from the 12-period EMA, you get the MACD line. A 9-period EMA of the MACD called the "signal line," is plotted on top of the MACD line, which provides the buy and sell signals. In other words, the MACD cross indicates a shift in momentum when the fast line crosses above or below the slow line.

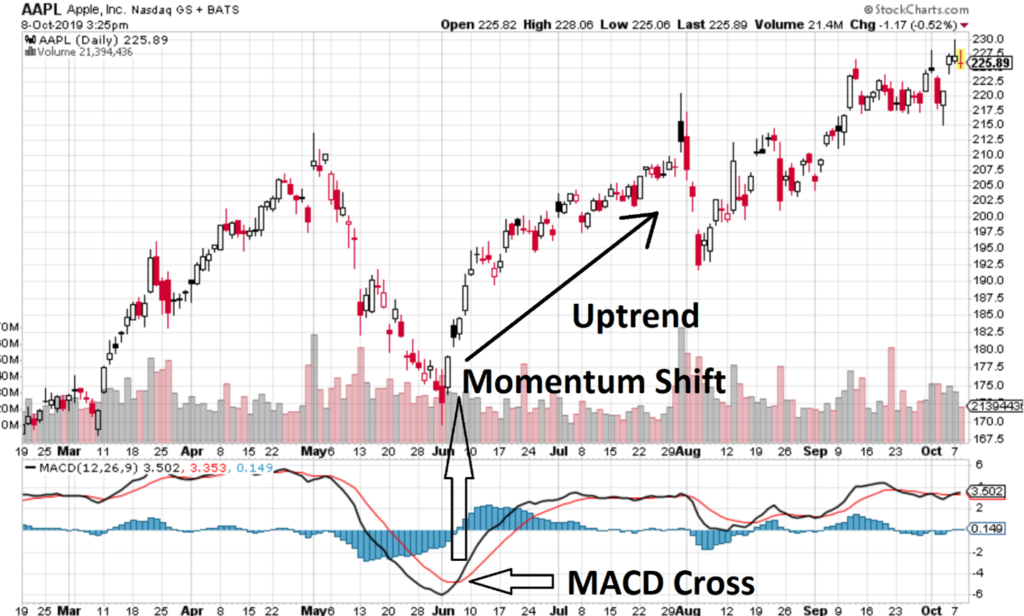

Let’s look at this on a daily chart of Apple, Inc. (Ticker: AAPL):

We can see the MACD cross that took place in early June when the signal line passed the MACD line following a steep sell-off, resulting in a buy setup. Over the next couple of months shares of Apple, Inc. rallied nearly 24%. In this scenario the MACD cross proved to be a very accurate indicator in terms of identifying the momentum shift and predicting a change in trend.

The MACD can also be combined with additional indicators to further strengthen signal accuracy. But, be aware that adding indicators of the same type may create redundant signals which can be misleading. For example, if you have two indicators which both calculate momentum, you may think that it provides additional confirmation. In reality it causes "multicollinearity" which is a statistical term that simply refers to multiple counting of the same information without adding additional insights. Believe it or not, this is not a good thing in trading.

To avoid this problem, it is important for traders to combine indicators that work well with each other. We recommend combining the MACD indicator with volatility divergence analysis, which we will introduce in the next section.

What is Volatility Divergence Analysis?

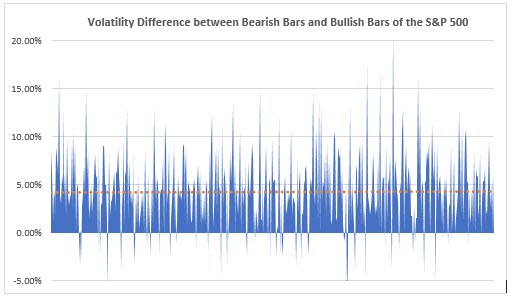

Volatility is defined as the range between the high and the low prices on any given day. Large ranges indicate high volatility whereas small ranges indicate low volatility. Interestingly volatility does not change randomly. Instead, it follows patterns which we, as traders, can take advantage of. One such pattern is the observation that for the vast majority of equities, the volatility on bearish days is higher than on bullish days. Let’s check out the figure below which depicts a relative comparison between the average volatility of bearish bars as compared to bullish bars across the S&P 500 stocks.

We can see that it is on average 5% higher – sometimes as much as 20% higher. This phenomenon can be explained as follows: Bearish bars, and more importantly down trends, are caused by sells offs which are often characterized by drastic price moves with high volatility. During these sell offs, investors are unloading their positions in a rather rapid fashion which causes swift price moves and increased volatility. Conversely when volatility is low, the market is considered as low risk which in turn encourages traders and institutions to re-invest into the market thus resulting in an uptrend.

This phenomenon not only exists with individual stocks but also with large ETFs and even major crypto currencies.

Now that we are aware of this phenomenon how can we use it to further strengthen the MACD cross entry signal? The answer is Divergence!

A divergence is a discrepancy between price movement and a technical indicator. In other words, price is going up while the underlying indicator is going down, or vice versa. For example, price may show a downtrend whereas the indicator is going up. Clearly, there is a mismatch between these two which may indicate a reversal in the market.

But how does this help us? Let’s take this case by case.

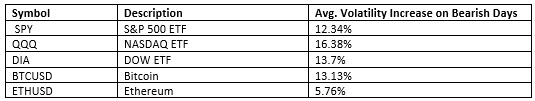

Case 1: The MACD generates a potential Buy Signal as the MACD line crosses above the signal line (1). We then want to back this up as follows. Let’s check for an upward trending price (2) while the Volatility is declining (3). The screenshot below shows such a scenario.

Not only did the MACD line cross with conviction above the signal line, but we also have a clear divergence between price and volatility. This is a solid setup with a lot of promise that the uptrend will continue for some time.

Case 2: The MACD line crosses below the signal line. We can strengthen this signal by ensuring that price is moving down and volatility is rising. This will increase the probability that a sell-off may occur and the downtrend will develop momentum.

The Missing Piece: Zillion Platform

Spotting ideal setups using momentum and volatility divergences is time consuming, especially on a daily basis. Manually analyzing one stock effectively could take as much as 20-30 minutes. Due to the sheer volume of stocks, finding these setups is not always feasible. In addition, good setups don’t present themselves often. But when they do, you don’t want to miss them.

Saying that, what if there was a sophisticated platform designed for traders that did all the heavy lifting and streamlined this complex process for you? To address this need, we’ve developed a platform that can do all of that and even more. Check it out here…

*Past performance is not indicative of future results.

THE SPECIAL OFFER

After spending over ten years educating traders, we’ve decided to compile our systems, methodologies and indicators into a very special dashboard called Zillion. The goal is to remove the guesswork from trading. Trading consistently is a challenge and finding ideal setups can be the hardest part, but it doesn’t have to be. Zillion’s powerful built-in scanner checks thousands of symbols every day for the next potential big move. Don’t worry about going through each symbol one by one. The scanner will tell you which symbols have a fresh setup in seconds, with just a few clicks.

Our team at Zillion has worked hard to build intelligent indicators which have predictive power. We take a unique approach to trading, where traders, software engineers and mathematicians come together to build innovative indicators. We use advanced calculations for our complementary indicators to make sure that our traders have the best tools at their disposal. The Zillion platform employs an optimized algorithm of the MACD cross system which will generate signals up to 3 bars earlier – thus getting you in at a much better entry price. We call this the “Trade Trend” entry. But there is more. Our team has created an innovative volatility divergence filter which will allow you to zoom in on the most profitable trades at a blink of an eye.

Everything at your fingertips from your browser, phone, or tablet. With Zillion, you can harvest incredible trade opportunities from the market with just a few clicks.

To help you get started, we have knocked the price down 50% to only $49 per month for a limited time. The Zillion Dashboard offers huge value without the hefty price tag. It’s made for Traders by Traders. To get started today, visit www.zilliontree.com.

Author: Jeff Tompkins, Daniel Sinnig

Company: Zillion

Websites: www.zilliontree.com

Services Offered: Trading Signals, Scanners, Market Analysis, Charting

DISCLAIMER

"This eBook is for information purposes only. Any products or services offered or recommended are not endorsed by OptionPub and neither the company nor its affiliates bear responsibility or control over the content of the information and the product or service offered. There is a very high degree of risk involved in trading. Past performance is not indicative of future results. The profits and performance shown are not typical, we make no future earnings claims, and you may lose money. OptionPub and all individuals affiliated with this site assume no responsibility for your trading and investment results. The indicators, strategies, columns, articles and all other features are strictly for communication purposes only and should not be construed as investment advice. Information for any trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. Your information may be shared with our educational partners. You must assess the risk of any trade with your licensed investment professional and make your own independent decisions regarding any securities or investments mentioned herein. Affiliates of OptionPub may have a position or effect transactions in the securities or investments described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies."

By Melissa Armo, TheStockSwoosh.com

Regardless of whether you have made or lost money this year, now is the time to start thinking about your trading goals for 2022. This should not be a big undertaking but will require that you sit down one morning and map out a plan of action for the next calendar year.

Start by asking yourself where you want to be one year from now? How much money you want to make trading? Are your current trading strategies working for you or do you need to research new strategies, markets and/or instruments to trade? If you lost money this year, this is especially important for your to do.

Hi there, my name is Melissa Armo and I am a big believer in building and executing a success-oriented personal trading plan and in this short video, I am going to share my favorite strategy for consistently making money in the markets. This is a strategy that I have perfected over time and is the central component of my trading plan...

SHORT VIDEO PRESENTATION: PLANNING FOR PROFITS IN 2022

THE SPECIAL OFFER

The Golden Gap Course

Get my comprehensive course and live training for trading the markets.

Author: Melissa Armo, Founder

Company: The Stock Swoosh

Websites: TheStockSwoosh.com

Services Offered: Trading Rooms, Trading Courses, Newsletters

Markets Covered: Stocks, Options

DISCLAIMER

"This eBook is for information purposes only. Any products or services offered or recommended are not endorsed by OptionPub and neither the company nor its affiliates bear responsibility or control over the content of the information and the product or service offered. There is a very high degree of risk involved in trading. Past performance is not indicative of future results. The profits and performance shown are not typical, we make no future earnings claims, and you may lose money. OptionPub and all individuals affiliated with this site assume no responsibility for your trading and investment results. The indicators, strategies, columns, articles and all other features are strictly for communication purposes only and should not be construed as investment advice. Information for any trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. Your information may be shared with our educational partners. You must assess the risk of any trade with your licensed investment professional and make your own independent decisions regarding any securities or investments mentioned herein. Affiliates of OptionPub may have a position or effect transactions in the securities or investments described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies."

By Steven Primo, ProTraderStrategies.com

How would you like to trade with clear and precise entry points including a high probability of catching the big trend? And how would you like to know all of these parameters before you even entered the trade? Join Steven Primo, Former Stock Exchange Specialist and 44-year professional trader, as he reveals “How To Become A Consistent Trader In 4 Simple Steps!” In this educational presentation Steven will not only walk you through the simple step-by-step process but share recent trading examples of this technique including:

Whether you are a seasoned pro or new to trading, you can’t afford to miss this special educational presentation.

SHORT VIDEO PRESENTATION: HOW TO BECOME A CONSISTENT TRADER IN 4 SIMPLE STEPS

THE SPECIAL OFFER

Get a 30-Day Trial of My PTS Primo Charts Program for just $7!

What you will get:

- A full, 30-day trial of my program for just $7

- You will get the trading strategy discussed in this video (Trading Strategy 3a)

- "STEPS" 1 & 2 Entry Techniques for fine-tuning your entries into trades

- Strategy Signal Scanner - Know which markets are triggered, according to the strategy

- Enhanced "BUY/SELL" line, which signals when markets are trending up or down

- Over 90 Technical Indicators

- Free Bloomberg TV for fundamental analysis

- Personalized Tech support for your individual needs

Author: Steven Primo, Founder

Company: Pro Trader Strategies, Specialist Trading

Websites: ProTraderStrategies.com, SpecialistTrading.com

Services Offered: Trading Courses, Trade Signals, Member’s Section, Videos

Markets Covered: Stocks, Emini Trading, Forex, Day Trading, Swing Trading

DISCLAIMER

"This eBook is for information purposes only. Any products or services offered or recommended are not endorsed by OptionPub and neither the company nor its affiliates bear responsibility or control over the content of the information and the product or service offered. There is a very high degree of risk involved in trading. Past performance is not indicative of future results. The profits and performance shown are not typical, we make no future earnings claims, and you may lose money. OptionPub and all individuals affiliated with this site assume no responsibility for your trading and investment results. The indicators, strategies, columns, articles and all other features are strictly for communication purposes only and should not be construed as investment advice. Information for any trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. Your information may be shared with our educational partners. You must assess the risk of any trade with your licensed investment professional and make your own independent decisions regarding any securities or investments mentioned herein. Affiliates of OptionPub may have a position or effect transactions in the securities or investments described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies."

By Silas Peters, SeasonalSwingTrader.com

In this chapter, I am going to share how I trade Historically reliable seasonal patterns AND coupled with Historically reliable chart pattern analysis.

When you combine the two together, any trader can put significant odds in their favor to capture seasonal trends and project moves as dictated by simple chart patterns.

Drumroll...Here is the Setup!

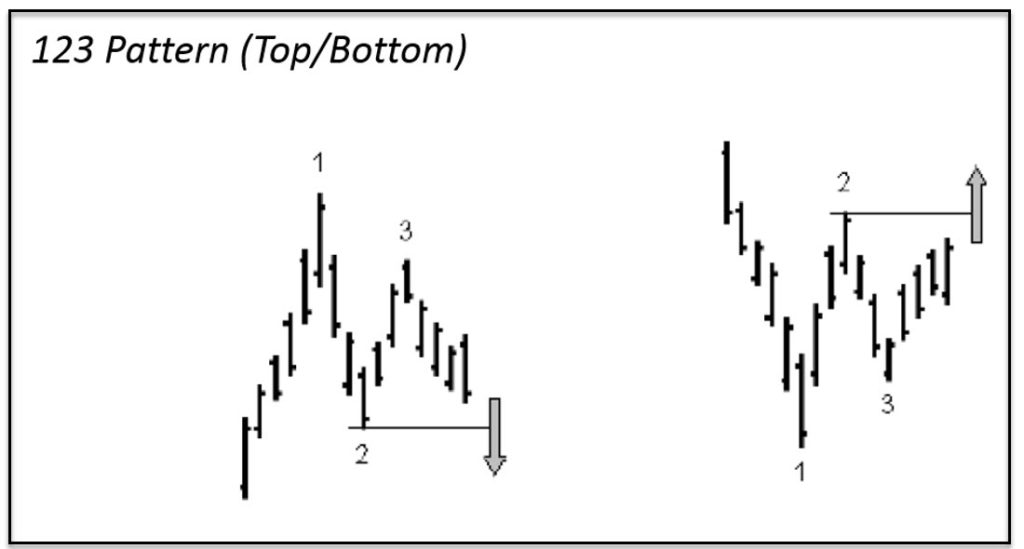

This pattern is sometimes referred to as the (A-B-C) Top/Bottom. It anticipates a change in trend from up tp down on a break below the “2” or “B” point. It anticipates a change in trend from down to up on a break above the “2” or “B” point. It is because the market fails to make a higher high or a lower low … the market is exhausted and ready to turn the tide so to speak.

Generally speaking, the more bars it takes to complete the pattern, the bigger the move, and the more accurate the signal will be. Again, confirmation of entry is on a break OR close above or below the “2” point.

Let’s look at some examples to put this into context:

123 TOP - Australian Dollar

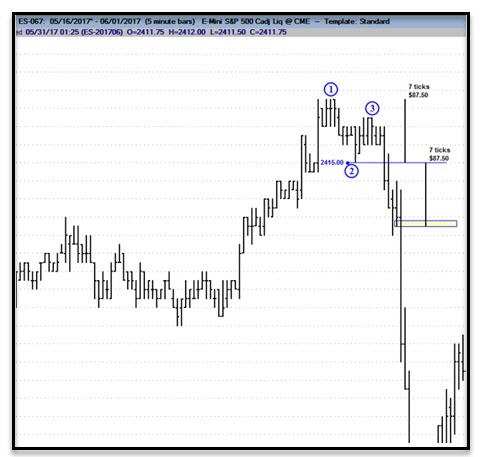

As I said earlier, we can trade this setup (“pattern”) on an intraday basis as well - see below a 5m chart of the ES (Emini SP 500).

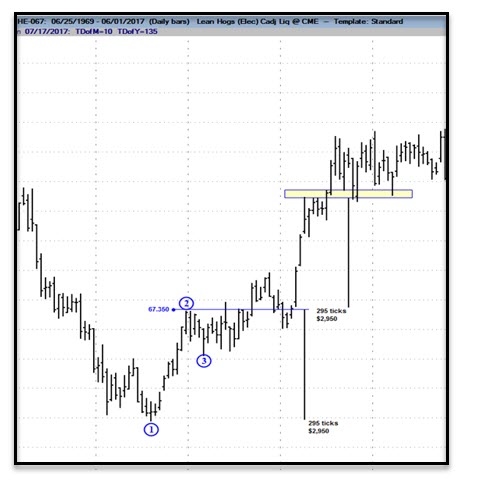

Here are a couple of examples of the 123 Bottom - same rules as the 123 Top but inverse. See this Daily Chart of Lean Hogs --

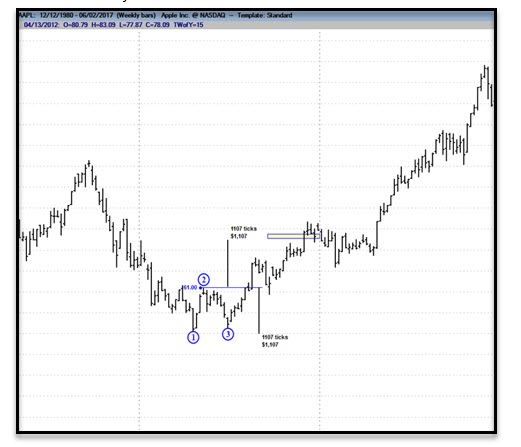

And this Weekly chart of AAPL --

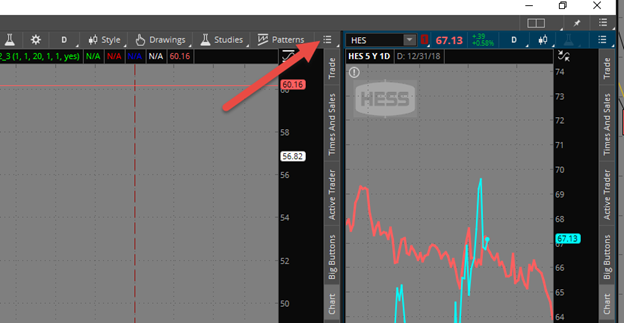

Okay, so by now you should be able to see how this very simple pattern works on any market and any timeframe. Let’s take a quick glance on how to incorporate with seasonality. Below is a Daily Chart of Hess Corp (HES). I have used drawing tools (yellow “1-2-3”) to illustrate the 123 bottom that formed in August. We have also added a free study that is included in the ThinkorSwim platform - the Seasonality Indicator

**To add, go to top right-hand corner of chart, select the 3-bar “sandwich” button, go to Style>Chart Mode>Seasonality. The turquoise line is the actual price; red line is seasonal price average

So, if we take a glance at what HES does on a historical seasonal basis, you can see that HES typically experiences strength in the late August / early September time period. This helps us with further confirmation on getting long, since we also have a 1-2-3 bottom formation taking place.

Once the price broke above the most recent red arrow (the #2 point), that was a trade confirmation. A more conservative entry is to wait for a solid close above the breakout point (#2), or wait for a retest of the breakout area - which we got both. Then, as you can see, the profit target was reached in approximately 10 trading days. Again, you know BOTH your profit and risk beforehand, and you can place your orders accordingly.

This trade was good for a little over $4.00, or $400 per 100 shares traded.

A trader in this example could have:

Let’s take a look at one more example - this is a daily chart on Live Cattle (/LE):

Here, we have a 1-2-3 Top formation that formed in May. From a seasonal perspective, we also know that the Cattle market tends to “top” out during this time period, thus indicating we have a high-probability trade at hand.

Approximately 3 months later, Cattle reached its profit objective of 13 points at 107.65, which is $5200 per single contract traded.

This is a trade that can be replicated by shorting Live Cattle futures, buying puts or put spreads or selling call spreads.

I hope that you have enjoyed this report and can see the importance of adding the 123 top and bottom pattern coupled with seasonality as part of your overall trade plan. Whether you are a stock, futures or options trader, Seasonal Swing Trader has a trade idea for you.

THE SPECIAL OFFER

Get Lifetime Access to the 3S Code Pro Indicator

YOU WILL ALSO RECEIVE THE FOLLOWING BONUSES:

Author: Silas Peters

Company: Seasonal Swing Trader

Websites: SeasonalSwingTrader.com

Services Offered: Trading/Investing education, trade ideas, courses, indicators, scanners, seasonality software

Markets Covered: Stocks, ETFs, Commodities, Futures, Forex

DISCLAIMER

"This eBook is for information purposes only. Any products or services offered or recommended are not endorsed by OptionPub and neither the company nor its affiliates bear responsibility or control over the content of the information and the product or service offered. There is a very high degree of risk involved in trading. Past performance is not indicative of future results. The profits and performance shown are not typical, we make no future earnings claims, and you may lose money. OptionPub and all individuals affiliated with this site assume no responsibility for your trading and investment results. The indicators, strategies, columns, articles and all other features are strictly for communication purposes only and should not be construed as investment advice. Information for any trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. Your information may be shared with our educational partners. You must assess the risk of any trade with your licensed investment professional and make your own independent decisions regarding any securities or investments mentioned herein. Affiliates of OptionPub may have a position or effect transactions in the securities or investments described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies."

By Larry Gaines, PowerCycleTrading.com

The markets have been on a fantastic run to the upside, and the higher the markets climb, the closer we are likely getting to a potential looming and inevitable fall. No one knows the exact timing of the next major market correction, but in this video, I'm going to layout a dynamic options strategy that can be used for hedging your trading or your investing gains.

I call this the Protective Collar Option Strategy and it combines two option techniques (a protective put and covered call) that generates income if the stocks you are long in should go down. This way you can place conservative trades in a market that may be topping out and are protected on the downside while retaining opportunity to the upside.

In this short video, I will take you step-by-step on how to set up a protective collar option trade that can be used to protect your overall portfolio, as well as take advantage of individual trades...

SHORT VIDEO PRESENTATION: HEDGING YOUR GAINS WITH THE PROTECTIVE COLLAR OPTIONS STRATEGY

THE SPECIAL OFFER

Test Drive My Power Cycle Trading Club Here

If you would like to learn more about trading price direction, options and much more then I hope you’ll take this opportunity to Test Drive My Power Cycle Trading Club by clicking on the button below.

Author: Larry Gaines, Founder

Company: Power Cycle Trading

Website: PowerCycleTrading.com

Services Offered: Trading Courses, Bootcamps/Coaching, Custom Indicators

Markets Covered: Stocks, Options, Futures

DISCLAIMER

"This eBook is for information purposes only. Any products or services offered or recommended are not endorsed by OptionPub and neither the company nor its affiliates bear responsibility or control over the content of the information and the product or service offered. There is a very high degree of risk involved in trading. Past performance is not indicative of future results. The profits and performance shown are not typical, we make no future earnings claims, and you may lose money. OptionPub and all individuals affiliated with this site assume no responsibility for your trading and investment results. The indicators, strategies, columns, articles and all other features are strictly for communication purposes only and should not be construed as investment advice. Information for any trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. Your information may be shared with our educational partners. You must assess the risk of any trade with your licensed investment professional and make your own independent decisions regarding any securities or investments mentioned herein. Affiliates of OptionPub may have a position or effect transactions in the securities or investments described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies."

marina Villatoro, The TraderChick.com

Ready for a secret hack when it comes to wins and losses with our trading? I’m Marina ‘The Trader Chick’, and today I'm going to give you a little trick for your trading wins and losses. Once you learn this, I know you will take your trading to the next level and start profiting consistently and with simplicity.

To begin with, let me tell you something. There is a thing called 'threshold' for your wins and for your losses.

So let me explain a bit what that means. Here's the reality, guys, everybody wants to make a ton of money. Who doesn’t want that, right.

I hear a lot of people saying ALL.THE.TIME: "I want to make a $1,000 a day",or "I want to make $500 per day."

Meanwhile, they're barely breaking even and even worse, making negative $50 to $100 a day.

Yettt…. In the same breath, getting greedier, saying things like: "I can make more. I could do more. I need to make more." Like they are entitled to make all this money, while not having a strategy or learning what to do.

But here’s the thing!

We have to have a threshold. A threshold for losses.

And, what nobody talks about is the ‘wins’ threshold. Which, I know is almost if not AS important as the loss for the day threshold.

Before we move on to the win threshold, what does the loss threshold really mean? Basically, it means how much money are you truly willing to lose for one day. But that takes into account that you actually have risk management in place, your stop loss. Because many people have a mental STOP loss in place.

Have you heard of that mental stuff, or how many times have you lied to yourself about the ‘mental stop’?

Yeah, I've been there. I've done that. I've lost several accounts. So what happens when we have a mental stop? The ego will always win.

Right. And we will never permit ourselves to admit that we're losing. If we are trained as strategic traders, we should have a risk in place. Plain and simple. No if ands or buts, it’s there without moving!

That way, we are telling the market this is all I'm willing to risk on this particular trade. You are in full control of that!

And what you're also doing is you are setting a very specific amount of loss for the trading day. Whatever your loss threshold is, let's say it's $100 or $200. It depends on you. You NEED to stick to that threshold.

We ‘get it’ to some extent, however, what people don't understand and never, ever consider is that there is such a thing as a win threshold.

What is a ‘win threshold' really mean?

It means you should also tell yourself the amount of wins you are going to permit yourself to have for the day. You have to be reasonable and realistic. Why? Because there is this thing called energy and energy exertion.

So we understand if we are taking trades that we are performing like an athlete. We have a practice and backtested, with the facts of our trade setups and their probabilities. We have a strategy and plan. Just like an athlete who has their technique worked out and practiced.

The best athletes regardless if they are scoring goals or missing passes, have their threshold. They know how much they can continue to play at top performance, and rarely do they push it. Because then it becomes fatigue and that can lead to disaster no matter how you pretend it won’t.

Energy exertion happens if you are winning or if you are losing.

Let me explain in detail. When you are taking a certain amount of trades, it doesn't matter if they end up winners or losers. You're sitting in front of the market and you are watching the market and you're seeing what's happening in the market. All this is activity. You're seeing the trade happen, and you put in that trade, you enter the trade, you're sitting there, and you win.

So what happens all that time? Your mind has been working. You might not be exercising, but you're using your mind, and it's a very exhausting activity.

So you're already using energy. And even if you win, you're all excited. More energy. We as traders, as humans, only have a certain amount of energy that we could really put in.

I'm going to give you an example. Michael Jordan, Michael Phelps. We know these names. These are the best athletes in the world.

I could go into many more. These guys are the best they could get. They know that they could probably only put in their best for an hour and a half, maybe two hours tops of their full on performance and energy.

And these guys train 8 hours per day.

They have been training for 20 years.

They are the MASTERS.

They know their exertion limit.

Yet, us day traders, we don't know that.

Not only that, but aspiring day traders think, "I can go for another trade." But they forget that their energies are done!

We as traders never want to go into emotional trading. That's when we stop being rational and stop taking valid trades.

Now, let’s look at the other side of the coin. We've just taken a trade that we know we can win, but sometimes the trade loses, and it sucks. Even if you know that particular type of trade wins 80% or 90% of the time. But in trading, this is normal!

Losses happen!

Guess what?

You just used energy. And you've actually used even more energy. Because it's an emotion that brings a negative reaction. Especially when we take a losing trade.

Going back to that analogy of Michael Jordan, and Michael Phelps. They're winning, and they're using energy. And they know that because they could only do a certain amount even if they're losing.

Another way to look at it, take out your phone. It’s been working all day, and you’re down to about 1%. When your phone is that low, would you take a super important call that can change your life?

Absolutely not, you know you need to charge it because what if it dies right in the middle of the thing that can actually be that game changer.

We humans are like phones, we need to recharge! We can’t be going full on all the time?

Back to trading, we'll use less energy when we're winning, which is understandable. But we're still using energy. We are still exerting ourselves. Now, if you're taking two or three losses in a row, your energy is going to go down super quick.

What does that mean?

Your battery is going to go down really quickly. You can become emotional a lot faster. You, as a trader, it is your job to stay strategic and tactical. And not emotional, that way you can be taking valid trades, and making good decisions.

So here's my exercise for you guys.

And I'm not even talking about the actual dollar amount, which is very important.

But also, sometimes you'll take three losing trades, and it won't come up to that dollar amount. But look at your energy. You'll see that your energy gets low.

What do you do about that? And what is your threshold? What is your threshold for losing trades? Because remember, we are like the phone.

If I'm going to be on my phone with a Zoom call that's going to take up my battery quicker. I know that I need to charge it. It's not going to go that much longer versus if I'm just scrolling around, and that could last a lot longer.

So you guys have to be responsible and that is your job as the trader.

That is my secret hack to you guys.

Understand your threshold.

THE SPECIAL OFFER

Did you know that Day Trading is over 80% mental strength?

I have a special mental training for Day Traders for $37 with bonuses that will definitely take you to the next level:

Author: Marina Villatoro, Founder

Company: The Trader Chick

Website: TheTraderChick.com

Services Offered: Trading Education, Boot Camps, Trading Community

Markets Covered: Futures, Equity Indices and Commodities

DISCLAIMER

"This eBook is for information purposes only. Any products or services offered or recommended are not endorsed by OptionPub and neither the company nor its affiliates bear responsibility or control over the content of the information and the product or service offered. There is a very high degree of risk involved in trading. Past performance is not indicative of future results. The profits and performance shown are not typical, we make no future earnings claims, and you may lose money. OptionPub and all individuals affiliated with this site assume no responsibility for your trading and investment results. The indicators, strategies, columns, articles and all other features are strictly for communication purposes only and should not be construed as investment advice. Information for any trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. Your information may be shared with our educational partners. You must assess the risk of any trade with your licensed investment professional and make your own independent decisions regarding any securities or investments mentioned herein. Affiliates of OptionPub may have a position or effect transactions in the securities or investments described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies."

By Serge Berger. The SteadyTrader.com

You may want to trade because of your interest in the financial markets and strong aspirations of becoming more active about managing your finances. Or you may want to trade because you’ve earned enough money and now want to be free of a boss, enjoy life, and yet still earn an income.

Whatever the reason for being interested in a more active investing/trading approach, this profession if approached the right way will allow you to actively manage money in all market situations while having the freedom to work for yourself. All the while you will want to be a student of the markets and gain an appreciation for some of the things that are critical for success as a trader.

Investors and traders are often overwhelmed by the choices available to them. From stocks and exchange traded funds (ETFs) to options and more, at the outset it can seem like an endless journey.

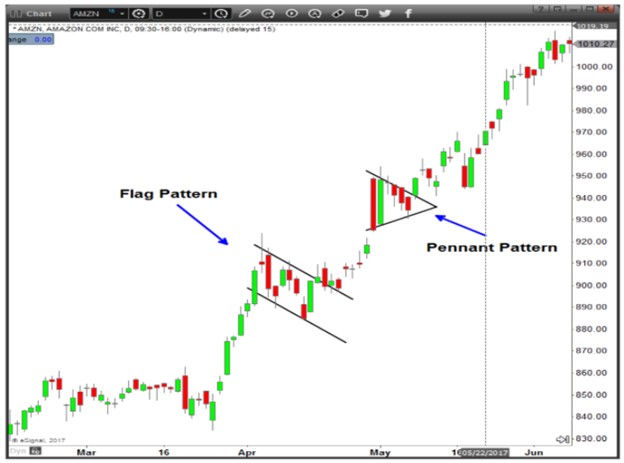

After 20 years as a professional trader, I can tell you that the simpler one’s approach to trading the stock market the better the returns over time and that mastering just a few specific chart patterns can make a massive difference in one’s portfolio returns.

You see, stocks, indices and other asset classes often form predictable patterns with decisively bullish or bearish outcomes. The fact is that being able to recognize these patterns as they develop, and pouncing on the confirmed high-quality signals, over time can amass wealth beyond your wildest dreams. Be persistent, specific, and patient!

Chart Pattern Types

Pick any random book on technical analysis off the library shelf and you are likely to encounter more ‘chart pattern’ types than you can shake a stick at. While surely most of these patterns have some merit, the fact is that only a few of them occur frequently enough and even fewer flash high probability signals to make them worth learning and paying attention to.

The chart patterns I discuss in this eBook are the ones that have given me a great edge over the course of my trading career. They have not just helped me reap great profits but also allowed me to contextualize trade setups and helped me analyze the broader markets. Lastly, these patterns allowed me to navigate the markets with good risk management, i.e., well defined stop-loss and profit targets.

As a big advocate of keeping things simple, I find that all of my high probability chart patterns fit into one of these three categories:

▪ Trend Reversals

▪ Trend Continuation

▪ Mean-reversion (i.e. overbought/oversold)

Trend reversal patterns signal the end of a trend in any given time frame and set up high probability trades in the new (opposite) direction

Trend continuation patterns or ‘consolidation patterns’ take place along an existing trend. After a stock in an up-trend gets near-term overbought it will slip into a consolidation phase to work off those overbought readings. The inverse happens on down trends. After some time these overbought readings have subsided and investors once again find enough appetite to push the stock higher along the primary trend and out of the consolidation pattern. Again, the inverse holds true for stocks in down-trends.

Mean-reversion patterns form when a stock becomes overbought or oversold and signals that it is in need of a pause and move lower (in up trends) or bounce (in down trends) before possibly resuming along it primary trend.

Traders and investors alike often fall into the trap of thinking they need to need to be able to determine whether a stock is about to end its trend or is just taking a pause. Focusing on high probability patterns solves this problem and allows investors to focus on profits.

Chart Patterns

Head & Shoulders Pattern

The formation of a head and shoulders pattern is one indication that a rising stock may be reversing its course.

Why it works

One of my key market observations over the years has been that stock market tops are process, i.e. take time, while stock market bottoms are points, i.e. happen quicker. The head and shoulders pattern represents this observation. The process by the bulls to hand the baton over to the bears takes time. But once it's obvious this has taken place, then a great trading setup takes hold.

How it works...