The name of this article is How to Turn Every Friday into a $1,000 Payday by Risking Just $1,500, all while having over an 82% to 92% chance of winning. We’re talking about creating a whole bunch of generous paydays on a whole series of Fridays, and I think you’re going to like what you’re going to learn.

If you’re not familiar with this strategy, I think it’s going to blow your mind. If you are already familiar with it, or you think you are, I think you’re going to discover some things that may surprise and inspire you.

So, how do we do it? How do we create these paydays? What do we do?

When it comes to stacking the probabilities, there is no strategy in existence that gives you a better chance of winning than credit spreads; that’s why I love them so much. That’s why you’re going to probably come to love them if you give this strategy any kind of a chance at all, but what we’re going to do here is really explain to you why this works so well and how it works. By the end of this chapter, I think you’re going to have a really good understanding.

Why is that?

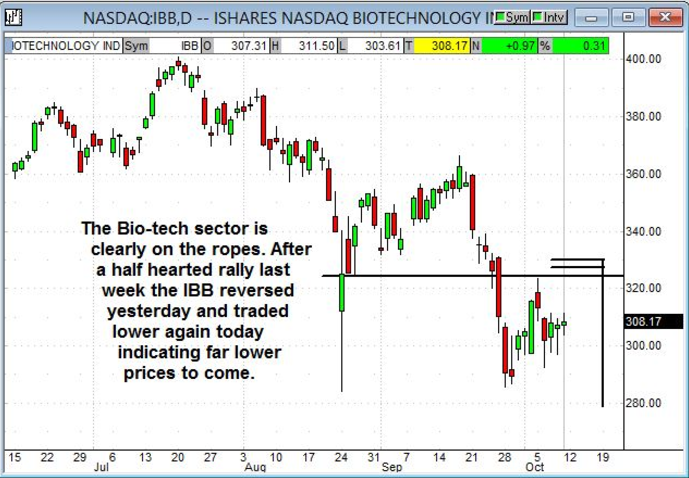

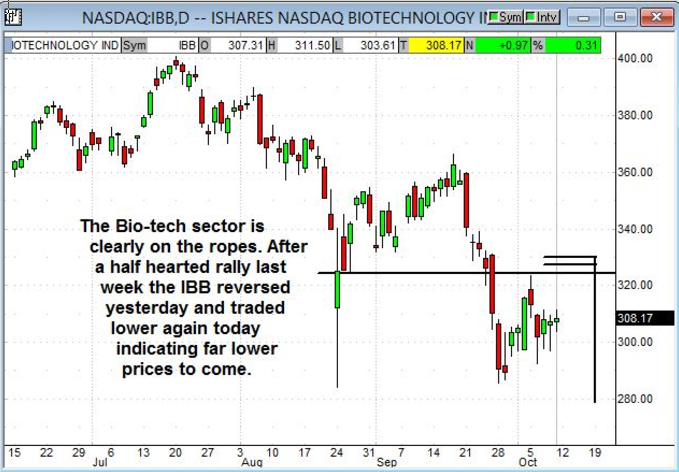

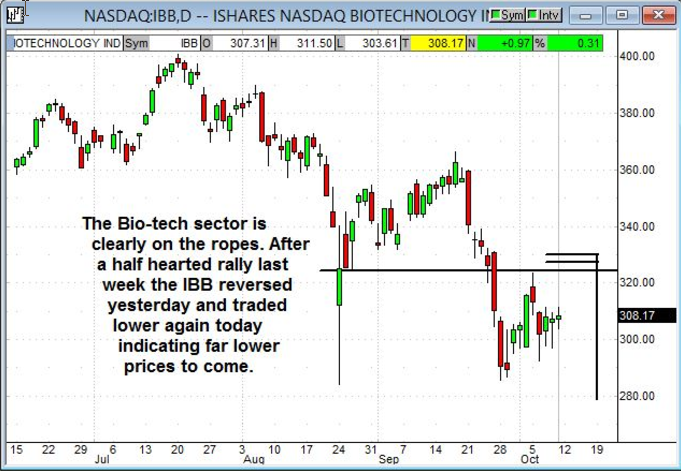

Credit spreads are a lot different than any other type of trading. With credit spreads, you don’t have to pick where the stock is going to go just where it’s not going to go, and that’s a whole lot easier. Let’s just take a look at this chart.

This is a chart of the biotech sector. If you’ve been following biotechs at all, you know that they peaked in July after a huge, incredible run, and they’ve been going down ever since. We have a trend in place that’s pretty easy to spot, and you don’t have to be a super great technical analyst to see that this sector is going lower over time here.

One of the keys to selling a credit spread is to position ourselves where we don’t think the stock is going to go.

If you think about it, that is so much easier than trying to figure out where it is going. With options, particularly time-sensitive options, you have to figure out when it’s going to get there, and that’s a pretty tall order.

I think one of the most common sayings amongst straight put and call buyers is, “The stock did exactly what I thought it was going to do…the day after expiration.”

With straight puts and calls, you not only have to get the direction right and where the stock is going to go, but you have to get the timing right. If that timing’s a little bit off, you know how frustrating that can be.

When you jump on the opposite end of that trade and you become an options seller, all of that time decay, all of that, “The stock didn’t do what I thought it was going to do in the period of time that I thought,” all of a sudden, all that jumps in your favor.

This strategy is very forgiving in that way. Even if you screw up a little bit on what you think is going to happen, about eight times out of 10, you just win in spite of yourself.

Maybe before, close only worked with…

How to Use the MACD Indicator

New PDF training guide explains the pillars of successful technical trading. Like how to understand common chart patterns, candlestick signals, stochastics and more.

I love that old saying. The point of it is that if you get your horseshoe close, within one horseshoe of the pin, you still get a point. With hand grenades, all you need to get is in the general vicinity of whatever you’re throwing them at, and it definitely has an effect.

We can now add one more to that last–because with credit spreads, close is good enough.

I have a little confession to make. When I first started trading options back in the mid-’90s, I thought, I’m going to be able to make money on this no problem because I’m so smart, and I’m so good, and I’m so quick. I’ll figure this out and I’ll just be better than the next guy, and I’ll make money.

I did make a little bit of money, but what I found is that this happened and that happened and the Federal Reserve said something they weren’t supposed to, or earnings weren’t what I thought, and, boom, I had many trades go sideways.

That got to be frustrating, and I started wondering, Who is collecting all this money? Where is all my money going? Is it going into a black hole? Is it going into a big incinerator where it’s getting burned up?

I started wondering what is happening, and what can I do about it.

All of a sudden, I had this huge epiphany. It was like this great light went off, like some kind of a spiritual experience, where I suddenly realized that the people who are getting all my money are the option sellers. I thought to myself, “Gosh darn it. Do you have to be in some kind of special club? Does your family have to be from a certain part of town? Did you have to go to a certain college? Do you have to be a certain nationality, a certain race?”

Then I suddenly realized, No. No, you just have to decide you want to jump on the other side of the fence. The club is not that exclusive, but what’s interesting is that most folks who trade options like to buy them because it’s so darn exciting.

Personally, I think what’s even more exciting is seeing a whole bunch of wins rack up in a row, and you get to have that experience when you get on the right side of options trading, which is actually, interestingly enough, the best-kept secret in the world.

It seems to be that the best side–the winning side–is the selling side.

With this kind of trading, you’ll automatically win most of the time, and here’s why:

There’s five things, and only five things, that a stock can do. Just take a look at this.

This stock is just going along. Maybe you’re looking at this chart, and you think, “Oh, it’s getting some resistance. Which way is this going to go?”

We have a nice little up-trend, but nobody really knows what’s going to happen next. Stocks jiggle around all over the place, and sometimes they really surprise you.

But what we can do is narrow down the possibilities.

-

This stock could go straight up. Some news could come out, and it could just launch to the moon.

-

It could go up in a more controlled, leisurely fashion. It could go sideways. We see that all the time, where it goes up and it goes down, but it does so in a little range.

-

It could drop a little bit. It could start fading and start falling off of a little high.

-

Maybe it’ll start going down.

-

Or, it could drop dramatically. Once a while, that happens. The cable on the elevator breaks and this thing just absolutely drops like a rock.

All five of these scenarios could happen. Let’s just say that we decided this thing’s hit resistance. It’s topping out. Let’s say we think there’s a good chance that this thing’s going to turn to the downside.

What we do, assuming that, is sell a credit spread.

We’ll look at these five scenarios. All that has to happen to make maximum profits on a credit spread is for it to go to its expiration date without having exceeded your sold strike.

Now, once we place this credit spread, if the thing drops like a rock, we make money. It’s like a game of tag when we were little kids. We’re just trying to keep our sold strike from getting touched by the stock or by the underlying.

If it goes down, it’s not going to get touched, so we win.

If it goes down a little bit, it just fades lower, and we win.

If it goes sideways and just bobbles along and doesn’t do much of anything, we win.

Even if it goes up, in the direction of our spread, but it just doesn’t go far enough and fast enough, we win.

The only scenario where we can possibly lose, is if it goes up really fast, really far. And if you’re any kind of a technical analyst, or if you just like to read charts, you could probably do a pretty good job of trying to figure out where that stock is not going to go.

That’s all you have to do to make money with this strategy, and as we’re going to see, the money you can make is pretty darn substantial.

Now, one of the crazy things about credit spreads is that most people don’t understand the risk/reward relationship.

I actually love it when people say, “I don’t like to do credit spreads because you can’t make very much money. You’re risking all this money, you could lose all this money, but you can’t make very money. I don’t like that risk/reward ratio. I’m not going to do credit spreads.”

When people say this, I think, Great, don’t do them. Be on the other side of the trade. Keep allowing me to sell you the options that you continuously lose on.

The way I look at it, there’s so many options buyers out there. So many people want to buy these short-term puts and calls and speculate on them. It’s like a line of people out your door down the street and around the block, as far as the eye can see, who are all waiting in line to hand you money.

I like the fact that a lot of people don’t do credit spreads, but I’ll tell you who does do them, anybody who understands numbers and probabilities because they understand this little picture that we’re looking at.

The people who love credit spreads are accountants, engineers, mathematicians, and so on.

My retired cousin out in Chicago is a chemist, a pretty bright guy, who loves credit spreads. He says he makes about as much money with his spread trades as he does with his retirement–and that he’s literally doubled his retirement by doing this.

People who understand what’s going on and understand probabilities love this. Because, once again, all that has to happen to make maximum profits on a credit spread is for it to go to its expiration date without having exceeded your sold strike.

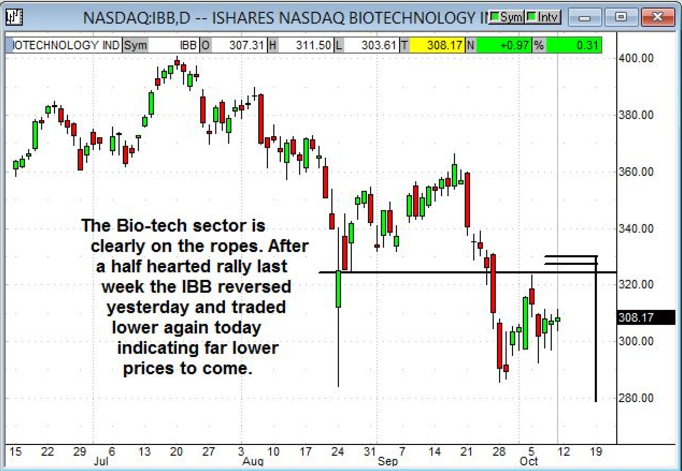

Let’s just take a look at this chart again:

Now, this is the biotech sector. You can see it’s recovering, although it’s forming a little sideways triangle pattern, and we could have a breakout one way or the other. You can analyze this until you’re blue in the face, but at a quick glance, what are the chances of this thing popping up, going above resistance, and getting into our spread before expiration?

Here’s what happens in the real world most of the time.

The stock goes up a little bit, it goes down a little bit. Some good news comes out that morning that pops up a little bit. Some bad news comes out the next day and goes down a little bit. It kind of does this or that, and what do you know? It just crossed the little finish line and you ended up keeping all the money.

That’s how you collect maximum profits on a credit spread. Pretty darn simple, and you’d be surprised how often this happens.

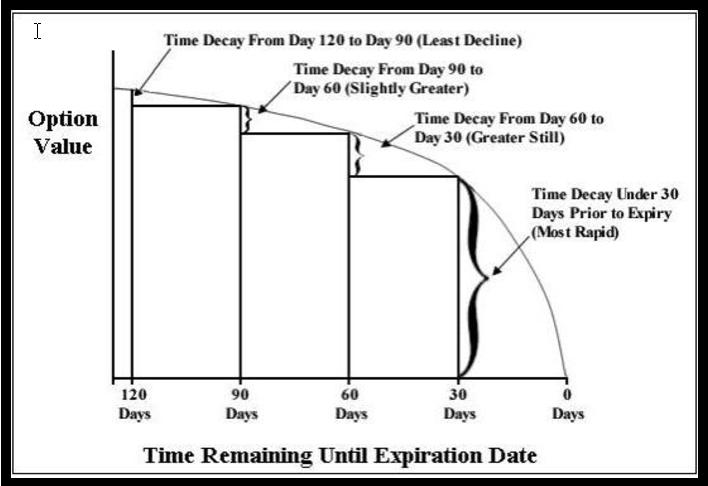

Now, when you sell an out of the money option, what we’re selling is time. It’s the time for something that could potentially happen. The stock could go crazy or the stock could crash, there could be all this movement and the option could be overrun, so that time has value. They put a price on that, and that is what we’re selling.

But as time runs out, so does its value.

In this particular case, we’re doing the IBB 327.50/330 call spread. Now, you can do $1 spreads, you can do $2.50 spreads, you can do $5 spreads, and when I say spreads, I mean the difference between the bought and sold strike prices–327.50 and 330 in this case.

We sold this spread for a 45 cent credit because I looked at the chart–at the two big red down bars–and thought, Boy, this thing’s rolling over. Looks like it’s going to just keep heading south, so let’s sell a call spread and collect some money.

Because of the volatility on this particular day–a pretty large move–the stock went down, it popped up–so we got pretty good money for this spread.

Once we subtracted what we bought from what we sold, we ended up with a 45 cent credit with nine calendar days left until expiration. (You take out two days for a weekend there, and you have seven trading days, nine calendar days.)

One of the things I love about credit spreads is you always know your finish line.

You always know how long the maximum amount of time you’re going to be in the trade. Just think about other ways that you’ve traded, and it’s this big question mark. With spreads, there’s no doubt about it. We have a finish line on every trade.

With seven days left on this example trade, the underlying kind of went against us. But because of time decay, because of volatility collapse, what we sold for 45 cents just two days later is worth 17 cents.

Can you see how forgiving this strategy is? The thing even went against us a little bit.

Now, this is what I want you to take away from this. That’s a 62% loss of value in just two trading days.

This is an amazing way to make money. It’s just, all other things being equal, you win more often, and I love that.

There are three factors that determine an option’s value.

- Time. How many days left until expiration? That’s just as easy as getting your calendar and counting, not too difficult.

- How close the strike is to the stock price.Let me give you an example. If the stock or index is at 100, and we’re going to sell something at a 102 strike, we’re going to get a lot more money than if we were to sell something at 110, because there’s a better chance of it getting overrun. What we’re trying to find is find the perfect spot right in the middle that’s just far enough out of the money that we’re pretty confident and pretty secure in this trade, but we’re also going to get some pretty good money.

- Number three–and this is a big one that gets overlooked by a lot of people, but it’s just huge–is how volatile the stock is. How much does it move?

I wish I had space in this chapter to delve more deeply into all three.

THE SPECIAL OFFER

The good news though is that I’ve put together a comprehensive webinar just to show you how amazing this strategy truly is–and I would like to invite you to join me.