July 06, 2016

Before we begin, here are some important facts about stocks pretty much from Day One:

And finally, and probably most important:

These stocks are seldom brought up on CNBC or pointed out in newsletters. Why? Because in both cases, they’re too busy blubbering on about what lower oil prices may mean to the economy, and whether it’s a safe time to buy some more Cisco.

So the question is:

How do you saddle up to the biggest stock moves in the land and catch some of the biggest moves of your trading career? (Especially using option leverage to carve out King-Sized home runs while tying up far less capital and risk than buying the stock).

How do you find them?

How do you get the confidence to buy them?

Is it easy?

Do you stand to lose your mind and your wits?

Can you still work the same amount of hours in your career? Or do you need to “put in the time” spending hundreds of hours becoming an expert in bio-science patents, or a pseudo expert in the new 3-D printing space?

Enter in the “Crow Bar”!

So what is this… and why the weird name? The visual here is to imagine this:

Picture a 400-year old sunken treasure chest that’s finally been hauled up to the surface. Its latches are locked and all crusted over. But a trusty CrowBar is just the leverage tool to jam in there to bust it open . . . and feel the glow on your face as all that shiny treasure stares back at you!

I’ve done many, many CrowBars in my time. They’ve always existed, and always will. And once you study up on the CrowBar, you’ll have a whole new world opened up to you. I want to say one final thing before revealing this to you. And that is, the reason I’m even writing this down and making this available so cheap.

After all, if this is “soooo compelling” and such a big money maker, why share it or sell it? Why not just keep quiet about it?

I have 2 reasons for this:

The Essentials

So now that I’ve got your attention, let’s continue. At this point I strongly urge you to become “unavailable.” That is, don’t check your email, return a text or take a phone call for the next little while. I give you permission to “unplug” so you can devour everything I’m about to share with you.

Okay, good. I seem to have your full attention (ain’t it a miracle in this day and age?!). Let’s roll up our sleeves!

The magic of the CrowBar is to get you and me involved in a stock when a huge EDGE sets-up for us…

This edge is: hopping on board a stock when normal growth turns into warp-speed-like growth, then hopping off when normal growth returns.

When we started, I mentioned some facts about stocks. #2 on the list was, “Stocks don’t go up in a straight line.” What I mean is . . . the most compelling growth stories out there do a lot of their growing in bunches, not in boring straight, ascending lines.

This is what’s known as. . .

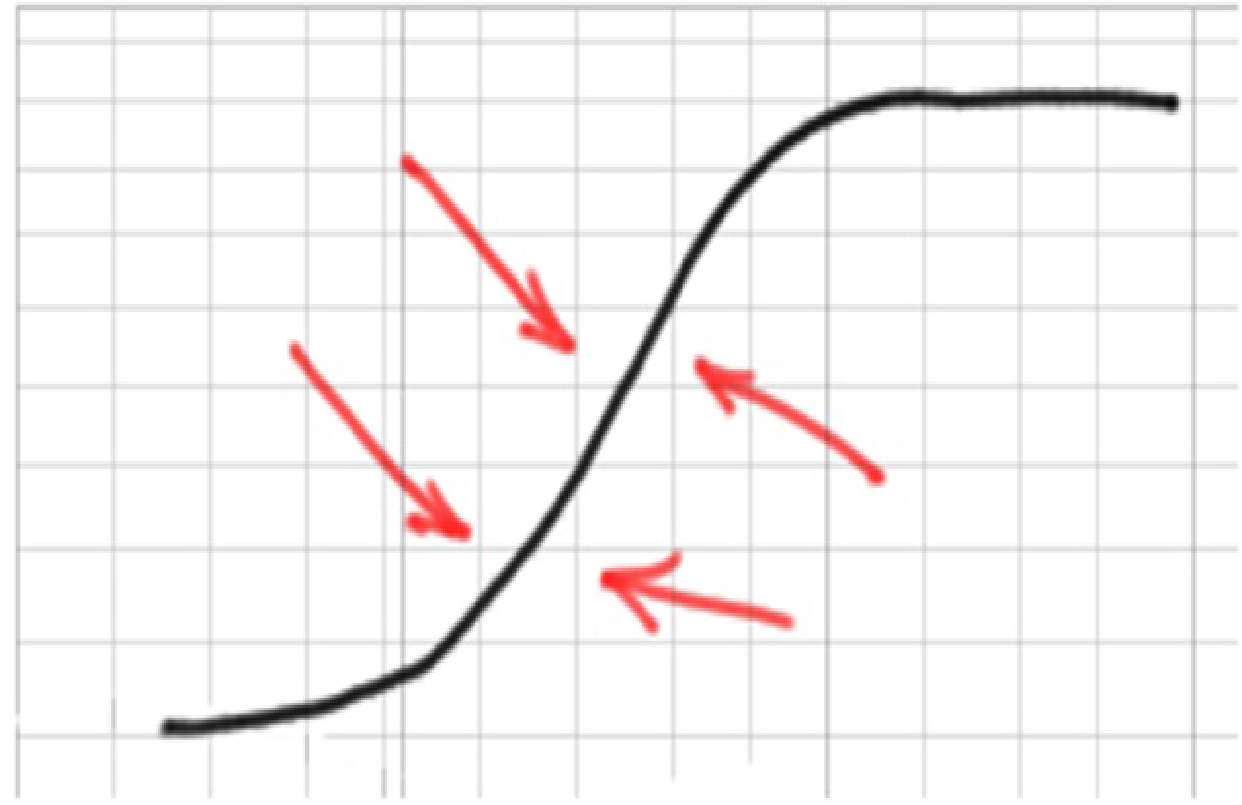

“S-Curves”

Certain periods of growth can be downright explosive, and that’s what the term “S-Curve” is all about. This is a growth spurt that looks like the letter “S”

S-Curve growth usually happens to newer companies feverishly growing and executing.

As you can tell, this is rapid, warp-speed-like action. And frequently, it’s a never-to-be-repeated phase of a company’s history.

Ok. Now that I’ve explained the “edge” of what we’re trying to accomplish as traders here, it’s now time to unfurl the rules for an official CrowBar Set-Up.

Each rule is critical. In fact, you need to find all of the following, or you don’t have a true CrowBar Set-Up! Here are the hard-won nuggets from the real-world trading trenches:

CrowBar Set-Up Rules:

These are the essentials!

However, you should take a look at these additional considerations and clarifications:

With that said, we want to get long for approximately one year.

I LOVE doing this with a long-term call option, or a LEAP. These are normally January options. In choosing a strike price, I’m almost always going for an in-the-money option. This way, for each $1 move in the stock we’re getting a pretty decent move in the call options. I search for a strike price where the premium paid is comprised of approximately half in-the-money (or intrinsic) value and half time value.

Additional considerations to keep in mind are:

How Do You Find Crow Bars?

New high list. Try to find the daily list of stocks that are hitting new 52-week highs. This is pretty much the only thing you need! I subscribe to Investor’s Business Daily and these new 52-week highs are listed in both the print and digital editions (the eIBD).

The ultimate resource is to check each stock that’s making a new 52-week high that day. Plain and simple!

Now let’s take a look at a couple of real world CrowBar examples:

Crow Bar Example: JAZZ

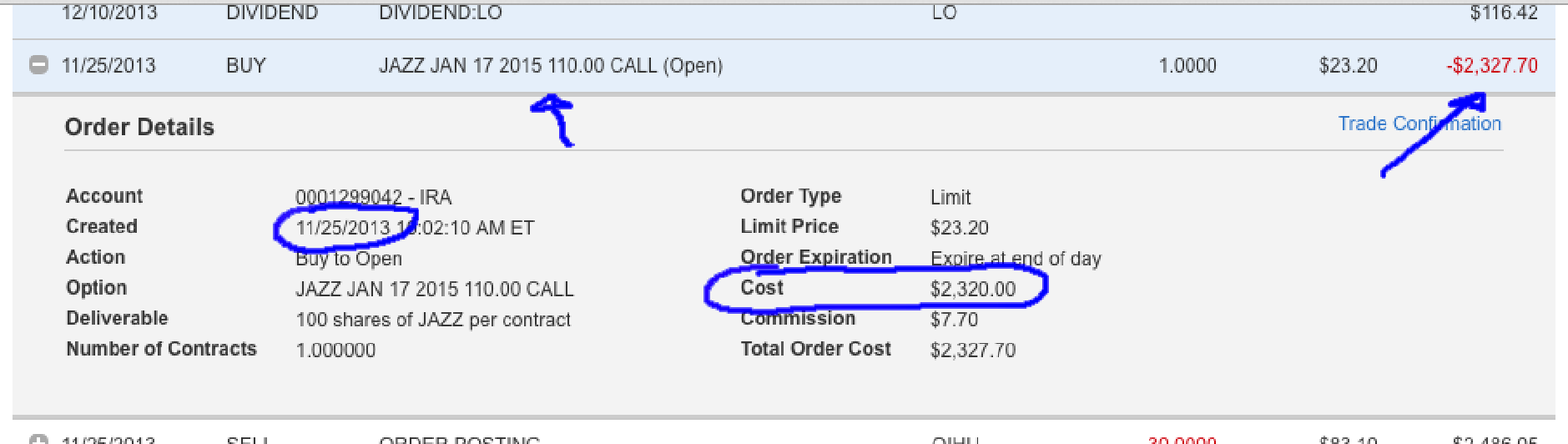

Here’s a real-world successful CrowBar trade. It was done inside an IRA account to boot! Here you can see a screen capture showing you the security name (JAZZ), the date I entered the trade, and the purchase price of the call options:

As you can see, on November 25th, 2013 it cost me $2,320 (plus commissions) to enter this trade. I bought one contract of the January 2015 $110 Calls at $23.20.

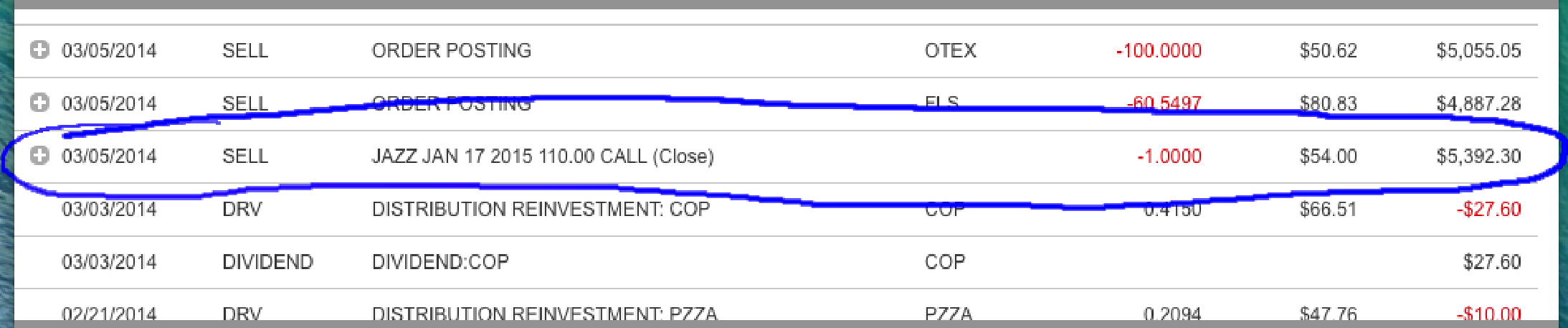

Now let’s look at a screen capture of the date and price where I exited this CrowBar trade:

From the above screen capture you can see that I closed the trade on March 5th, 2014. When I closed the trade, the same January 2015 $110 Call was worth $54… or $5,392 (after commissions).

I profited $3,072 on a $2,320 investment. A cool 132% return on investment. Here’s what this same CrowBar trade looks like on a stock chart:

Let’s look at another example:

Crow Bar Example: REGN

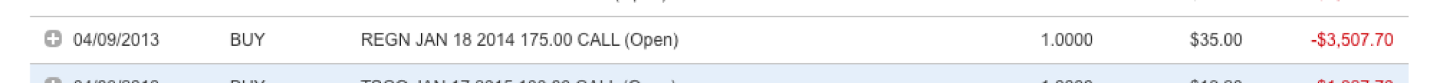

Here’s another CrowBar trade done in the same IRA account. Again, here’s a screen capture where you can see the security name, the April 9, 2013 entry date, and the purchase price of $35 for the January 2014 $175 Call options:

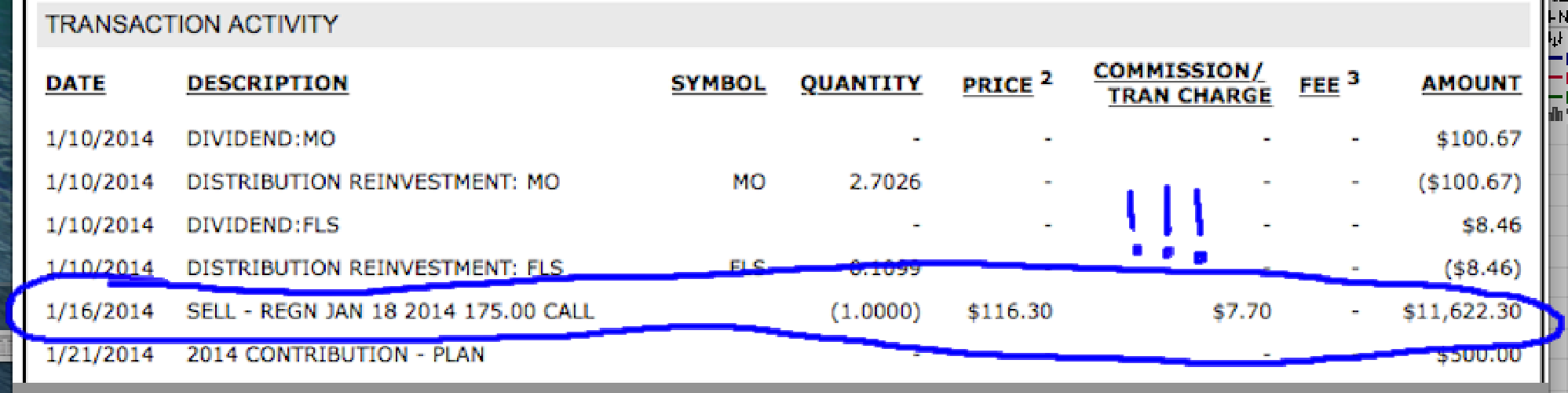

Next, here’s a screen capture of the date and price I chose to exit the CrowBar – selling the calls:

If you did a double-take… I don’t blame you! Because yes, you read it right – a single call option contract was sold for over $11,600 bucks! It cost me $3,500 to enter the trade… and when I exited they were worth $11,630.

A stunning 231.3% return on investment!

Here’s what this CrowBar trade looks like on a stock chart:

Crow Bar Example: QLYS

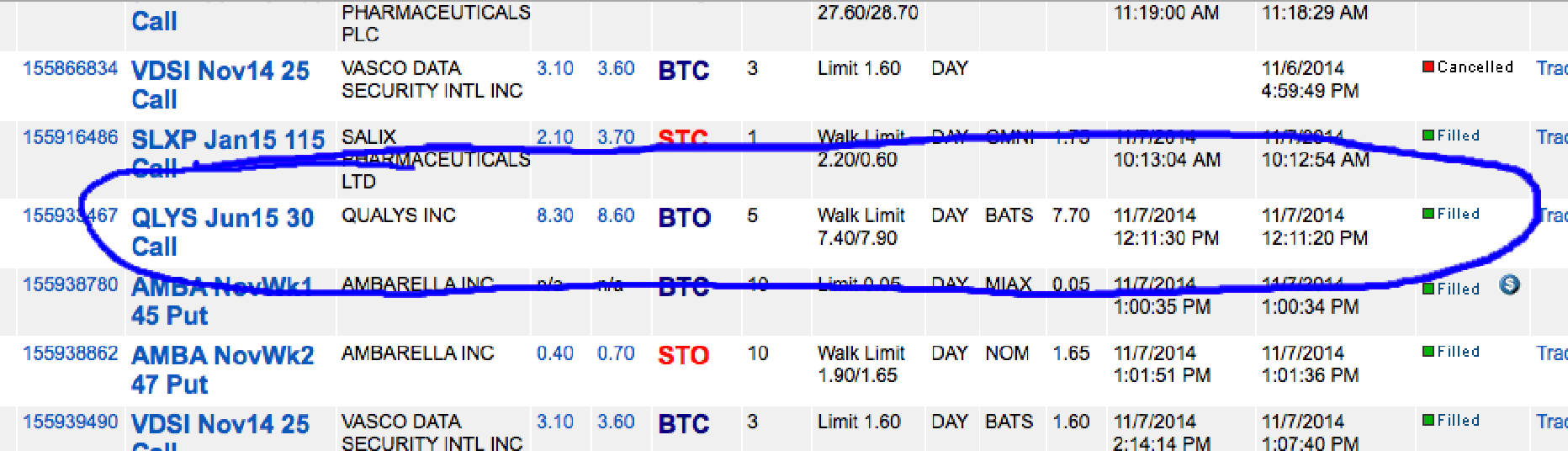

Now let’s look at another CrowBar trade done in a different account of mine. This next screen capture shows where I purchased the June 2015 $30 Calls on 11/7/2014. And you can see I paid $7.70 per contract for these call options:

Next, here’s what this CrowBar set-up looked like on a 1-year chart:

And here’s the “all-time” view of QLYS:

**Note on this example. . . There is no sell date yet as QLYS is a brand new CrowBar I recently got into!

CrowBar “Enhancer” Strategy – Selling Weekly Options For Opportune Income

Owning a long term call option (LEAP) is a lot like owning the stock itself. In fact, the technical term in the options world is a “synthetic long” position.

What this means is: having the “right to buy the stock” gives you some of the same privileges. One big plus is the ability to sell calls against your position – the same as if you owned the stock itself!

With a crowbar position, however, my main goal is intense capital appreciation from the stock going up and simply owning the long-term call (LEAP) options.

But it’s still fun to enhance profits by selling calls, especially weekly calls (if available) along the way!

Not all crowbar trades will have weekly options traded on them, but that’s ok. Even with the traditional monthly options, you can sell them, say, two weeks before they expire and still collect some additional premium (profits) along the way.

So when do I become an opportune call seller on a CrowBar position?

First of all, all future earnings dates need to be mapped out and known. This is oh, so very important! You don’t want to sell an option – unknowingly – over the earnings date!

Repeat After Me... “Know Thy Earnings Dates!”

The most important thing (besides the date of the next earnings announcement), is to take note how the stock has behaved during the last 2-3 earnings announcement periods.

Since we’re talking about a stock with pumped-up momentum, I specifically take a look at the stock’s behavior during the 1-month period of time leading up to its past two or three earnings announcement periods.

(Finding past earnings announcement dates is not hard. You can always google them!)

Perhaps the stock really gets excited and likes to rally during this 30-day period before earnings. If that’s been the trend, then let the stock price run (and hence the value of your LEAPs!).

If you notice more random behavior in the stock (during the 1-month period before the earnings announcement), perhaps you more aggressively sell call options for income during that time.

Always, always be careful when you sell a weekly call for income purposes! I always try to evaluate how much a stock typically moves (up and down) in a given week, then try to choose a strike price outside of this range to sell (for the week).

It’s not uncommon to see premiums of $1.00, 3-4 strike prices OUT OF THE MONEY . . . for a SINGLE WEEK OF TIME! (52 weeks X $1.00 equals a lot of money over a year’s time…chances are, way more than the cost of your CrowBar!)

Finally, it’s not uncommon for CrowBar type stocks to get mentioned in the news often while you own them. Here’s a little tip that helps me when surprise news hits the stock. I call it the 3-Day rule.

For example, if the stock suddenly gets an upgrade, it will probably bolt up higher on day one. Perhaps it trades up some more on day two, then succumbs to profit taking on day three. The point is, the stock is probably done reacting to the sudden news after 3 days.

For selling calls (collecting income) purposes, I like to sell out of the money call options AFTER a scenario like this – to rake in some additional income along the way (I’ll often sell one or two strike prices out of the money to give the stock even more cushion to run higher)

To repeat, you don’t ever have to sell any calls against your CrowBar! The above ideas help define when I do so. And finally . . .

Here are some other things I look for while I’m in a CrowBar trade. Every few days I’ll note things like:

What’s important to keep in mind is the uniqueness of a CrowBar situation. These are often triple-digit stocks that are hot and bothered and active. Big institutional money is either funneling money into them and/or watching them like a hawk.

Your intuition will also kick in after a while. You will OWN this intuition.

Why? Because that’s what happens when you OWN something instead of paper trade something!

You’ll get to see how your stock does on poor market days (if it’s attached or detached from the overall market). You’ll get to see the volume come in every day. If it’s traveling lower (in its uptrend), you can notice if volume is picking up there or decreasing, etc.

Conclusion

Happy CrowBar hunting! And remember, weekly options are an enhancer along the way. I don’t want this to blow your mind – but it really IS a mind blower!!!

Talk Soon, Preston “Pirate” James

SPECIAL OFFER

If you would like to learn more ways to improve your trading, get the Money Press Trading Strategy Package. Some of the benefits you will gain include:

Protection is built right into all of the trades (so you can sleep at night!)

There is NO MORE being glued to 6 monitors all day long. It just takes 20-30 minutes, a few times per week

$600, $700, $800, $900 stocks are all well within your reach, even with a small account

And much more

Preston James is the founder of investor education company Traders Edge Network. Preston is a veteran trader of 22 years with a heavy emphasis on options and options strategies.

Jon “Dr J” Najarian, a 25-year CBOE floor trader, says this about Preston:

“I’ve known Preston (aka ‘Pirate’) for coming up on a decade now and he’s one of the sharpest option traders around. He’s constantly creating opportunities – he is also one of the best I’ve ever seen at exploiting those opportunities.”

Preston’s the creator of Weekly Options Windfall, a popular home study course focused on creating income from weekly options. He’s very passionate about finding the market’s buried treasure (hence the ‘Pirate’ nickname).

Preston’s also known for his Pre-Announcement Profits training, creating the “1% Solution” investor guide, as well as the Trader’s Edge Podcast. He’s also interviewed many of the top traders and investing minds on the planet.

Preston was a walk-on linebacker who earned a full-ride scholarship as a 2-year starter at the University of Utah. He graduated with a B.S. degree in Finance.

DISCLAIMER

There is a very high degree of risk involved in trading. Past results are not indicative of future returns.OptionPub.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for any trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. By downloading this book your information may be shared with our educational partners. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of OptionPub.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.