March 24, 2016

Did you know that 69% of the new millionaires created last year are a result of the stock market? It’s true. This is an opportunity that stands right before of you. Every day stocks go up and down and someone makes a profit. The question is, how can you win in the stock market?

And, contrary to popular belief, the biggest threat to your wealth is the age-old idea of “buy and hold” investing. Millions of investors, have fallen prey to this antiquated, failed system and have lost tens of thousands dollars.

To be successful in the stock market you need to take control and be in charge of how your assets are invested. It's time to stop giving the market permission to steal your hard-earned money. And to do this, you will need to discover for yourself how to produce consistent, and reliable investment results month after month and year after year.

Many market experts suggest we could be heading towards another market meltdown. If this is the case, there are only three ways to make consistent money in a bear market:

At WallStreetWinning we only recommend #1 and #2, and in this article, we will focus on how to make money trading options in a bear market.

To begin with, you must effectively protect yourself and look for stocks with excellent fundamentals. Companies with proven fundamentals will go up and down with the market, but will be around for the long haul. Since we know the market may be falling, you will want to buy a stock that you feel will recover over time. In this case, while the stock is falling you will be writing calls and puts on the way down - and on the way up taking monthly income to the bank. Further, I suggest holding 10 Stocks/ETF’s or more for diversification and to spread out the risk over various market sectors.

This technique will require you to Sell Calls and Puts at a 50/50 ratio for maximum protection and gains. But how do I know when to sell options? Well that is the easy part. Wall Street Winning has an up to the minute Options Signal for you. The computer mines the available options with the best premiums and highest probability of success for maximum monthly income. All that you need to do is make the trades as the computer does all the work finding the best opportunities that fit the strategy perfectly.

Many people think that options are difficult and too abstract of a concept to consistently make money with. And without the aid of computer programs and scanners, that is probably true. But now you have the opportunity to easily follow options signals and make consistent income on a regular basis.

So how does the Monthly Income Options Strategy work?

This strategy is designed to allow you to build a portfolio that provides the opportunity to generate an income stream on a continuous basis.

Strategy

Buy a stock and sell an at-the-money or slightly out-of-the-money call option. Then also sell a put option at a strike price below the current market price with a low probability of assignment.

OUTLOOK

Expecting the stock to trade in a channel such that the call is assigned and the put expires worthless.

ACTIONS

If both the call and put expire, sell another call and put a week to ten days out for income generation. If the call expires and the put is assigned, sell calls on the full position at a strike price that is approximately ten percent above the current market price going out no more than one month. If the call is assigned, review this or another candidate for a new covered call and naked put opportunity.

EXPECTED RETURN

If the call and put expire, the return is the call and put option premium received. If the call is assigned the return is the call and put option premium plus any price appreciation in the stock which is limited by the strike price of the call sold.

RISK

Risk is related to stock ownership. It is reduced by the amount of the call and put option premium received. To exit this trade buy the call back to close and sell the stock. Wait for put expiration or sell the position when assigned. Breakeven is the stock purchase price less the call and put option premiums received.

This strategy is a combination of a covered call and a naked put. It provides a way to generate excellent returns while building a stock portfolio with good companies.

You can apply this strategy at any time, but I find it most useful when investing in a new good company for the first time. Let’s say you were planning to commit $20,000 to an investment. You can invest it all up front and buy 2000 shares at $10 per share and write a covered call. If the stock does not perform as expected you might have unnecessarily increased the risk. Why not reduce the risk by buying half of our desired position now for the covered call and sell a put at a strike price below the current price of the stock. Now if the stock goes down before the put expires we will buy our full commitment with an overall lower entry price. If the put expires, the return on our initial position is enhanced by the value of the put premium received. If this is done in a margin account, the value of the first commitment can be used as the margin for the put sold. However, caution must be used in the level of margin committed in the account. Limiting the use of margin to about 40% of the margin available can usually sustain severe market corrections.

After experiencing a number of option cycles with the new stock, one can move to a full covered call strategy.

This strategy can be repeated over and over when a stock or ETF trades in a channel or small range. For example, buy at $15.50; sell a call at $16 and a put at $15. If the stock does not move much you continue with a new call and put in the channel range. If the stock moves up, you implement a call and put in the new range. If the stock moves down, you usually can sell calls at the lower strike price and still generate an acceptable return. This gives you a positive return on the investment, even when the price of the stock goes down.

The following examples demonstrate this strategy in detail.

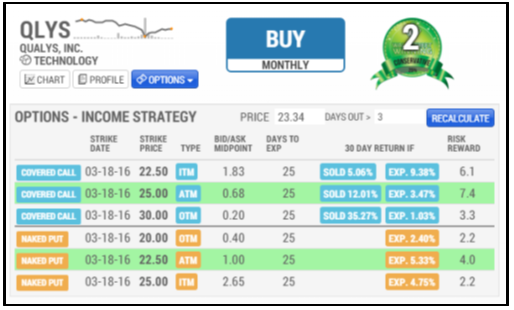

QLYS was identified as a BUY on 2-23-16 by WallStreetWinning.

This presents the opportunity to enter a position on QLYS and sell Calls and Puts to create an income stream that could go on for a long time.

The option to select is highlighted in the WSW Options Panel.

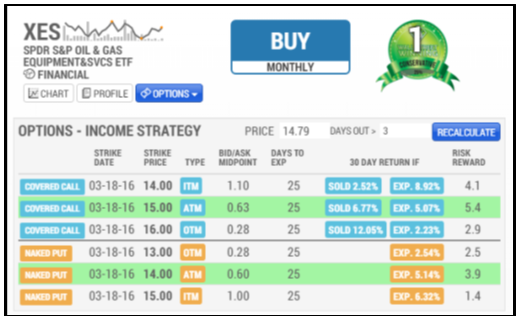

XES was identified as a BUY on 2-23-16 by WallStreetWinning.

This presents the opportunity to enter a position on XES and sell Calls and Puts to create an income stream that could go on for a long time.

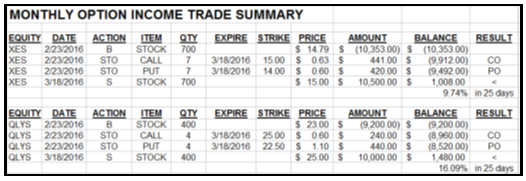

A summary of the trade detail is as follows:

Action at expiration date:

You can be a successful investor as any other, by using Winning Signals. It works for the most conservative investors to the most high-risk, aggressive investor. Why? Because, it uses math and science to give you the best possible outcome. This alone gives you both an advantage and a strategy in your investing. Strategy is the cornerstone of making money in the markets.

This is where judgment and style of investing enter the picture. I personally believe it is more productive to take a number of small gains to the bank over time rather than going for the big win. Singles and doubles win a lot of baseball games. Home runs are nice but very unpredictable. There is nothing sexy about unpredictability. Sex appeal and confidence go hand in hand. Greed is not sexy. Losing is not sexy and most certainly, striking out is not sexy.

There is no need to get greedy and try to triple your money overnight. It’s just not attractive and, more times than not, it is gambling and you will end up a long-term loser. You may think you are

missing out on the out of the park “big one” gain, but the trade data shows that you can be just as successful with a slow moving industrial like MSFT versus a high fashion trendy stock like NKE. Predictability, dependability, and financial stability is sexy, and that is what will make you richer.

Special Offer

So I hope that you learned something from reading this short excerpt. As a SPECIAL GIFT for giving me your valuable time, I want to give you an entire month of the Monthly Income Options Strategy for only $12.

https://win.wallstreetwinning.com/optionsin

This is 98% off the monthly subscription price of $99 - and we are 100% sure that if you take action and follow our advice, that you will become more consistent and confident in your trading activities.

Ron Groenke was a NASA mathematician who discovered the stock market secret to low risk and big payoffs. He created an algorithm utilizing techniques he learned at NASA, and adapted them to the stock market with returns of 20-25%, winning 80 percent of the time. Ron is the Founder of StreetWinning.com

DISCLAIMER

There is a very high degree of risk involved in trading. Past results are not indicative of future returns.OptionPub.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for any trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. By downloading this book your information may be shared with our educational partners. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of OptionPub.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.